Once again, the coronavirus dominated financial markets this week. In doing so, markets posted nearly unprecedented daily movements. While stocks posted enormous losses, bonds lost some of their appeal as an alternative. Thus, mortgage rates rose roughly one-half percent from recent record-low levels.

Coronavirus Dominated Financial Markets

Since the outbreak of the coronavirus, investors generally reduced risk in their portfolios by selling stocks and buying bonds. This includes mortgage-backed securities (MBS). Due to the added demand for mortgage-backed securities, mortgage rates experienced a decline.

As the coronavirus dominated financial markets, the heavy stock market selling continued this week. However, many investors show apprehension to purchasing bonds at current low yields. Investors anticipated that the government fiscal stimulus will be funded by increased issuance of Treasuries. Therefore, a larger supply of bonds pushes yields higher.

Federal Reserve Reaction as Coronavirus Dominated Financial Markets

While the coronavirus dominated financial markets, economists widely agree on the appropriate response to help offset the economic effects. Economists believe that government-backed fiscal stimulus and central bank-supported monetary stimulus would do the trick.

While the proposed government action takes some time to implement, global central banks quickly added monetary stimulus this week. The United States Federal Reserve expanded its bond purchase program and provided much needed liquidity. The European Central Bank (ECB) held rates steady at Thursday’s meeting. Having said that, the ECB also provided additional lending programs to support troubled businesses.

Core CPI Rises

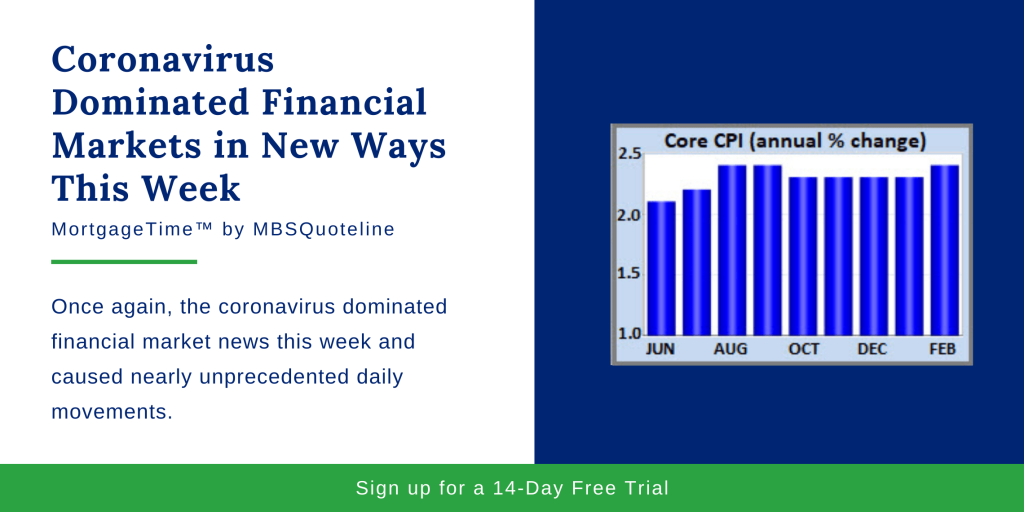

The most significant economic report released this week indicated that core inflation remained stable in recent months. Analysts widely follow the Consumer Price Index (CPI) report because it looks at the price change for goods and services.

In February 2020, core CPI, which excludes the volatile food and energy components, rose 2.4% higher than a year ago. Additionally, Core CPI jumped up from an annual rate of increase of 2.3% as last month.

Looking Ahead as Coronavirus Dominated Financial Markets

Because the coronavirus dominated financial markets, investors primarily look for updates in the coming week. At Wednesday’s Federal Reserve meeting, investors predict a rate cut.

Meanwhile, the week’s biggest economic report comes out on Tuesday with the publication of the latest Retail Sales data. In addition, news about the United States elections hold influence over mortgage-backed securities.

With the continuing impact of the coronavirus, mortgage rates climbed approximately half a percent from the previous week’s record-low levels. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.