As consumer spending surges again, retail sales also faced a tremendous week. Despite the stronger than expected economic data, investors focused on the concerning spread of the coronavirus in many areas. Thus, mortgage rates dropped slightly to fresh record-low levels.

Consumer Spending Surges Again

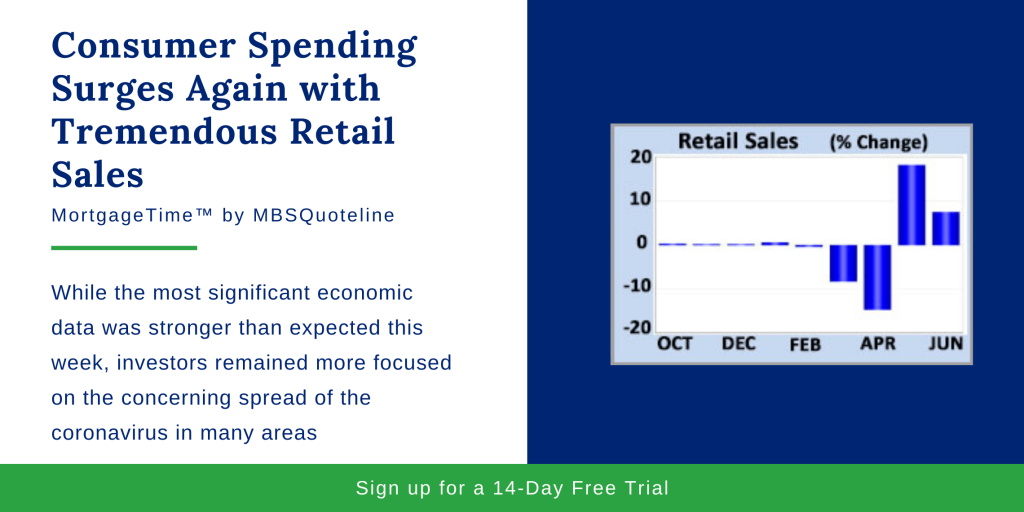

Due to the pandemic-induced economic shutdown, consumer spending dropped sharply in March and April. However, the past couple months saw a swift rebound take place.

While consumer spending surges again, retail sales jumped 7.5% from May. Overall, the retail strength distributed broadly. Consumer spending accounts for about 70% of all economic activity in the United States. Therefore, the retail sales data indicates current financial conditions.

Housing Sector Quickly Rebounds

As consumer spending surges again, so, too, does the housing sector. In June, housing starts surged 17% from May. Meanwhile building permits, a leading indicator of future construction, rose modestly from May. The NAHB housing index showed that home builder confidence shot up from 58 to 72, far above the consensus forecast.

Several large home building companies commented that they are hiring back workers. Also, these companies plan to restore disrupted supply chains to meet the unexpectedly large demand for homes. Since a lack of inventory held back home sales in many regions, this news was very encouraging.

European Central Bank Reveals No Policy Changes

Aside from the consumer spending surge and housing market rebound, Thursday’s European Central Bank (ECB) meeting revealed no policy changes. ECB officials expect rates to remain at their “present or lower” levels.

This expectation remains until they see the outlook for inflation rise to their target level of 2.0%. Subsequently, ECB officials project that European economic growth will decline by 8% to 10% this year.

Looking Ahead After Consumer Spending Surges Again

After consumer spending surges again, investors watch for news about medical advances, Fed actions, government fiscal stimulus programs, and the economic reopening. Beyond that, we’re looking at a light week for economic data.

Conclusively, analysts fully concentrate on the housing data. While Existing Home Sales release on Wednesday, New Home Sales come out on Friday.

Following the latest news on consumer spending surging again, mortgage rates dropped to new record-low levels. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.