With the recent economic shutdown, mortgage rates dropped slightly to new record-low levels this week. Although investors witnessed a historic GDP report, it fell in line with expectations. Similarly, the Federal Reserve meeting caused little reaction.

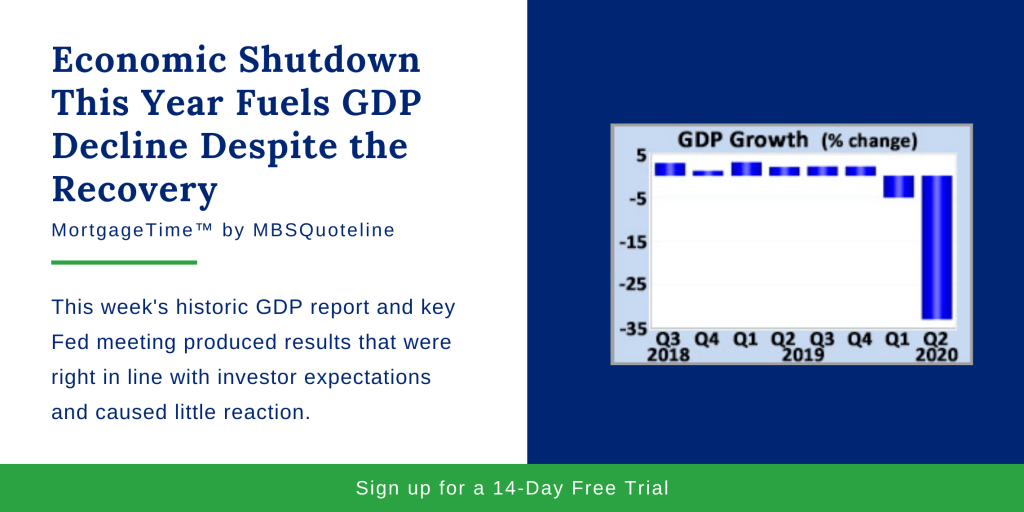

GDP Dropped Nearly a Third Due to Economic Shutdown

Gross domestic product (GDP) represents the broadest measure of economic growth. Investors braced themselves to see a massive decline of around 35% for the period from April through June due to the partial economic shutdown.

Thursday’s report revealed that second quarter GDP fell a record 32.9%. On a brighter note, more recent data indicated that the economic recovery generally continues to pick up at a faster than anticipated pace.

Inflation Saw Decline in Line with Economic Shutdown

As expected, the Federal Reserve held the fed funds rate steady at Wednesday’s meeting. Chair Powell repeated the message that the Fed will use all its tools to support the economic recovery for as long as necessary. Because of the economic shutdown, the Fed purchased over $2.5 trillion of Treasuries and mortgage-backed securities (MBS) since March to help lower bond yields and boost growth. Thus, investors closely watch for changes in the Fed’s level of asset purchases or other monetary stimulus measures.

The reduced economic activity resulting from the pandemic caused a decline in inflation. Therefore, mortgage rates stayed low. In June, the core PCE price index rose just 0.9% higher than a year ago. Also, core PCE declined from an annual rate of increase of 1.0% last month. Overall, the Fed favors core PCE as its go-to inflation indicator. They continue to target annual inflation of 2.0%.

Government Launches Enhanced Unemployment Benefits

In March, the government initiated an enhanced unemployment benefits program through July 31st as a means of balancing the economic shutdown. In conclusion, the number of people who qualified increased and weekly payments rose by $600.

With millions of Americans still out of work due to the pandemic, there is widespread support for additional aid. However, lawmakers failed to agree on the details of a new program. Having said that, it’s not yet clear when one will be implemented.

Looking Ahead After Economic Shutdown News

After the latest news surrounding the economic shutdown, investors continue watching for news about medical advances, government stimulus programs, Fed monetary policy changes, and plans for reopening the economy. Next week, the ISM national manufacturing index releases on Monday. Later, the ISM national services index comes out on Wednesday.

Beyond that, the monthly Employment report publishes on Friday. These figures on the number of jobs, the unemployment rate, and wage inflation reflect the most highly anticipated economic data of the month.

Following the latest of the economic shutdown, mortgage rates hover at their highest point since the middle of 2019. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.