This week, the latest labor market report came out, reflecting a plunging unemployment rate and massive job gains. Although the reporting demonstrated stronger-than-expected economic data, mortgage rates faced a minimal impact. In conclusion, mortgage rates ended the week with little change. To date, mortgage rates still hover near record-low levels.

Unemployment Rate Plunges as Economy Shows Massive Job Gains

With Friday’s monthly labor market, the United States continues to displayed a faster-than-anticipated economic rebound. Despite the partial economic shutdown, the United States added a massive 1.37 million jobs. Government hiring, retail, and professional services reflected strong job growth. For perspective, typical monthly readings were for job gains of around 200,000 in 2019.

Despite the massive job gains, the big surprise came in the form of a plunging unemployment rate. From a level of 10.2% last month, it plummeted to 8.4%, far below the consensus forecast of 9.8%. In terms of progress on the recovery, this declined nearly 15% in April. However, unemployment still hovers above February’s rate of 3.5%. While large companies provide the job growth figures, the Labor Department conducts a household survey to find the unemployment rate.

ISM National Manufacturing & Services Indexes Rose

While the unemployment rate plunges, the Institute for Supply Management shared its national manufacturing index and national services index. Overall, both reflect the swifter than expected pace of the economic recovery.

Achieving its highest level since November 2018, the ISM national manufacturing index increased to 56.0. On the other hand, the ISM national services index showed an even stronger 56.9. Both indexes decreased to levels between 40 and 45 a few months ago after the partial shutdown of the economy. Readings above 50 indicate an expansion in the sector.

Looking Ahead as Unemployment Rate Plunges

After the news on the plunging unemployment rate, investors continue watching for news about medical advances, government stimulus programs, Fed monetary policy changes, and plans for reopening the economy. Beyond that, we’re looking at a light week for economic data.

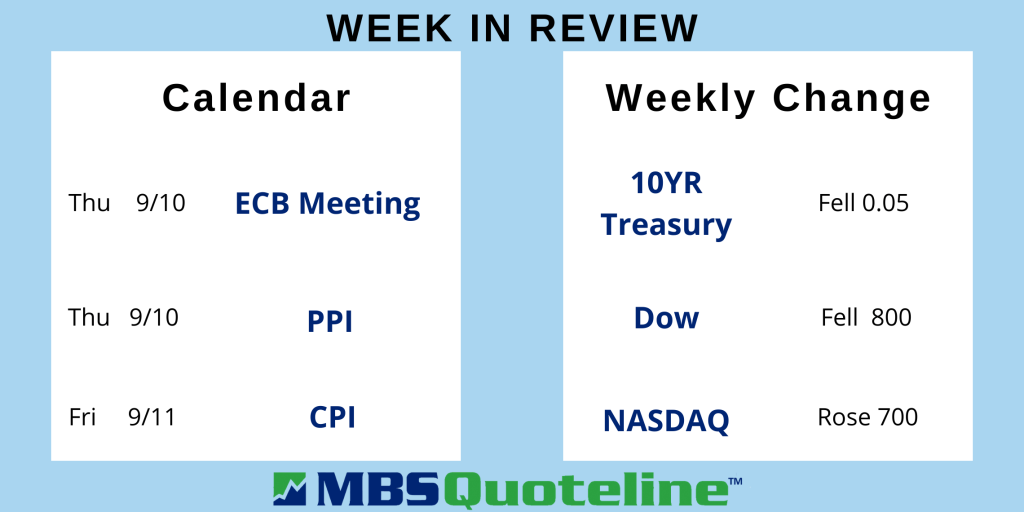

Mortgage markets close Monday in observance of Labor Day. Later, the next European Central Bank meeting takes place on Thursday. Finally, the Consumer Price Index (CPI) publishes on Friday. Investors widely follow CPI for price change for goods and services.

As the unemployment rate plunges, mortgage rates still hover around record-low levels. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.