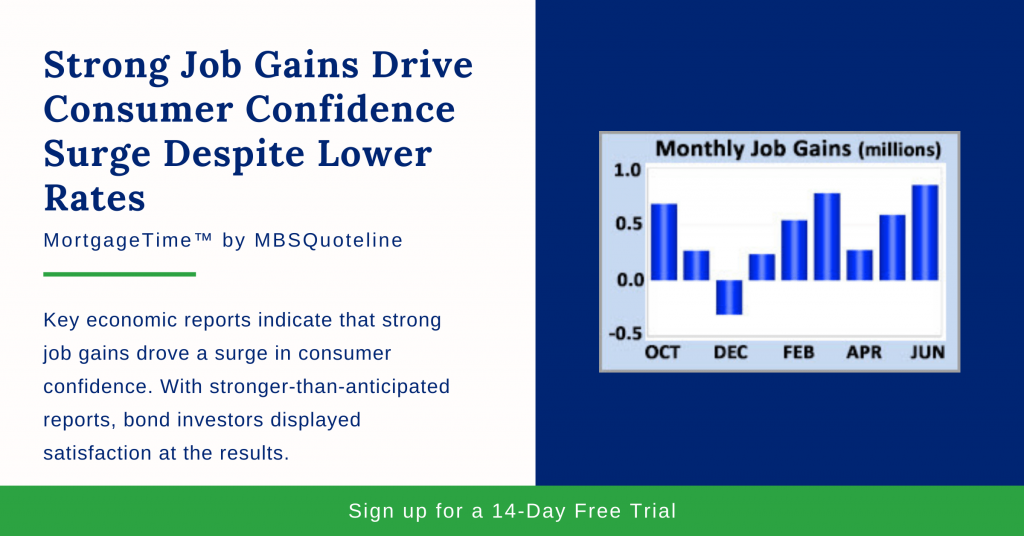

Key economic reports indicate that strong job gains drove a surge in consumer confidence. With stronger-than-anticipated reports, bond investors displayed satisfaction at the results.

Primarily, investors felt content that the data didn’t show any huge upside surprises. In conclusion, mortgage rates ended the week a little lower.

Strong Job Gains

Against a consensus forecast of 700,000, the economy gained 850,000 jobs in June 2021. In doing so, the economy achieved its highest level since August 2020. Hospitality and education realized particular strength.

Meanwhile, the unemployment rate increased from 5.8% to 5.9%. Although this statistic rose above the consensus, it still faced a slight decline. Thus, more people joined the labor force.

Finally, average hourly earnings jumped 3.6% higher than a year ago, matching expectations. In addition, average hourly earnings saw an increase from an annual rate of 1.9% last month.

Manufacturing Indicates Growth

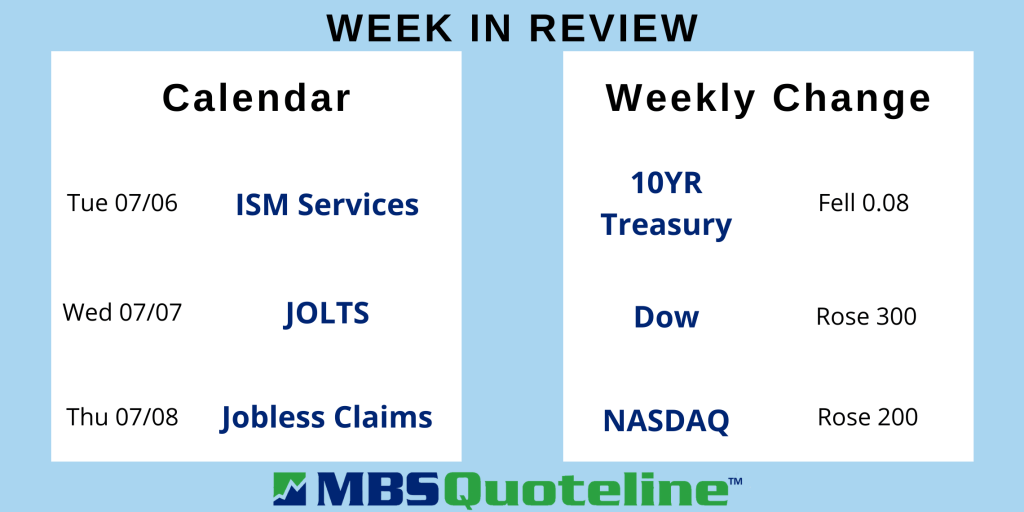

Aside from the strong job gains, the Institute of Supply Management (ISM) released another significant economic report. Manufacturing remained at remarkably high levels, as expected.

The national manufacturing index came in at 60.6. Readings above 50 indicate that the sector is expanding. Of note, a large number of companies reported difficulties in hiring enough workers to keep up with growing demand.

Consumer Confidence Surges Alongside Strong Job Gains

U.S. Consumer Confidence unexpectedly surged this month. Consumer confidence reached its highest level since February 2020.

Analysts attribute this in part to the ongoing vaccine distribution. Also, the U.S. economy continues to reopen. Lastly, consumers feel better about economic and labor market conditions, especially with the strong job gains.

According to the survey, most consumers plan to increase their spending. Economists notice a particular emphasis pandemic-restricted areas, such as travel and dining out.

Looking Ahead After Strong Job Gains

Looking ahead after the strong job gains, investors closely watch COVID-19 case counts around the world. Investors also look for hints from Fed officials about the timing for changes in monetary policy.

On the reporting front, next week contains little economic data. Most notably, the ISM national services index releases on Tuesday.

Mortgage markets close at 2PM EDT today. They also close on Monday in observance of the Fourth of July.

Want to see how strong job gains affect mortgage-backed securities? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.