With Wednesday’s Federal Reserve meeting, the continual conversation revolving the Fed tapering bond purchases took an interesting turn. While inflation ran amok to kick-start 2022, the latest Federal Reserve statement led investors to anticipate a faster pace of monetary policy tightening.

Overall, the news generated a negative impact for mortgage rates. On the other hand, the major inflation and growth data barely affected mortgage markets. As a result, mortgage rates climbed a bit to the highest levels since early 2020.

Fed Tapering Bond Purchases Sooner Than Anticipated

As expected, the Federal Reserve meeting statement indicated that the Fed plans on increasing the federal funds rate for the first time since 2018. The Federal Reserve hopes to lower inflation. In addition, the meeting revealed more information on the Fed tapering bond purchases. Federal Reserve Chair Powell said that their massive balance sheet of mortgage-backed securities (MBS) and Treasuries purchased to aid the economy early in the pandemic is now larger than needed and should be scaled back.

Conclusively, the Federal Reserve failed to provide a specific time frame for these policy changes. Currently, investors expect that the first rate hike occurs at the next meeting in March and that balance sheet reduction will begin this summer. While Fed Chair Powell didn’t provide a target for the total number of rate hikes, he said that “there’s quite a bit of room to raise interest rates without threatening the labor market.”

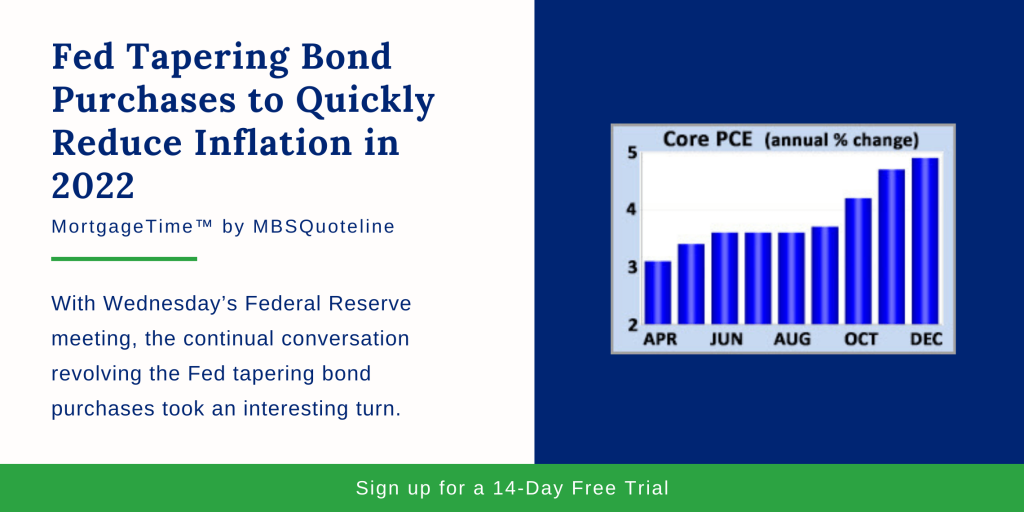

Core PCE Achieved Highest Annual Rate since 1983

The latest Core PCE report reemphasized the need for the Fed tapering bond purchases. As always, the Federal Reserve favors the PCE price index as its go-to inflation indicator. In December 2021, core PCE increased 4.9% higher than a year ago. Also, Core PCE climbed up from 4.7% last month, achieving its highest annual rate since 1983.

For comparison, readings fell below 2.0% during the first three months of 2021. Now, investors wonder how quickly inflation will moderate as pandemic-related disruptions resolve.

GDP Exceeded Consensus with Consumer Spending & Inventory Strength

Aside from the Fed tapering bond purchases, Gross Domestic Product faced less of a COVID-19-induced impact during the final three months of 2021. Gross Domestic Product (GDP) represents the broadest measure of economic activity. Fourth quarter GDP showed annualized growth of 6.9%. Not only did this result exceed the consensus forecast of 5.5%, it jumped up from just 2.3% during the third quarter.

Looking at the report, consumer spending and inventory replacement demonstrated particular strength. As the economy recovers, 2021 GDP hit its highest annual growth since 1984. Consumer spending and inventory replacement showed particular strength.

Looking Ahead After Markets Focused on Fed Tapering Bond Purchases

After the mortgage markets focused on the Fed tapering bond purchases, investors closely follow news on the Omicron variant. Also, investors seek additional Fed guidance on the pace of future rate hikes and balance sheet reduction.

Next week, the ISM national manufacturing index comes out on Tuesday. Later, the ISM national service sector index releases on Thursday. Concurrently, the next European Central Bank meeting takes place on the same day.

Beyond that, the key Employment report publishes on Friday. These figures on the number of jobs, the unemployment rate, and wage inflation represent the most highly anticipated economic data of the month.

After news on the Fed tapering bond purchases, mortgage rates hit their highest levels since 2020. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.