This week, mortgage rates continued their shockingly swift while Powell tightened monetary policy further. Thus, mortgage rates reached the highest levels since early 2019. Analysts attribute the cause to inflation.

In fact, inflation climbed to the highest levels in decades. However, the Federal Reserve surprised investors with details regarding rate hikes. Hopefully, the action leads inflation to reverse course.

Powell Tightened Monetary Policy

For months, the Federal Reserve discussed combatting inflation. Throughout the pandemic, the Fed launched a bond purchase program designed to boost the economy. Now, the Federal Reserve plans to reverse the extremely accommodative policy measures. At the Federal Reserve meeting, Powell tightened monetary policy.

First, he achieved this by raising the federal funds rate 25 basis points at its last meeting on March 16th. This left investors to question how quickly the Federal Reserve intends to raise rates. Since the start of the year, investors shifted from pricing in roughly three rate hikes of 25 basis points each in 2022 up to the equivalent of eight by year end. Also, investors anticipate possible increments of either 25 or 50 basis points at each meeting.

Investors “Caught Off-Guard” as Powell Tightened Monetary Policy

In a speech on Monday just days after the meeting, Fed Chair Powell caught investors off-guard. With his comments, Powell emphasized the need to aggressively fight inflation. Powell pledged to “take the necessary steps” to get inflation under control. This will happen even if it means raising the federal funds rate by more than 25 basis points at a future meeting.

Investors see this latest move as a continuation of Powell’s monetary policy tightening. Powell explained that the timing is uncertain for relief from the resolution of supply chain disruptions caused by the pandemic. Additionally, the Russia-Ukraine conflict and China’s COVID-19 outbreaks increase inflationary pressures.

Powell Tightened Monetary Policy but Addressed Investor Concerns

Although Powell tightened monetary policy, he also directly addressed investor concerns that the Fed might tighten policy too much. Essentially, investors fear that the rate hikes might slow the economy in the long run. To recap, the Fed loosens monetary policy to boost the economy during periods of weakness, such as after the start of the pandemic.

By contrast, when the economy exceeds a certain capacity, the demand for goods and services becomes so strong that prices must rise to balance supply and demand. Eventually, this forces the Fed to tighten. The pandemic and Russia-Ukraine conflict made inflation even worse than usual, since manufacturing heavily constrained and the supply of key commodities is shrinking.

Investors use the term “soft landing” to describe implementing the optimal level of tightening. Basically, a soft landing represents the point that restrains economic growth just the right amount to bring down inflation without causing an undesirable recession. Powell expressed optimism about achieving a soft landing. The Federal Reserve’s success holds heavy influence over future mortgage rates.

New Home Sales Declined While Prices Soared

Sales of new homes declined for the second straight month in February. As a matter of fact, new home sales dropped 2% from January to an annualized rate of 772,000. Therefore, new home sales declined below the consensus forecast of 810,000.

Overall, the median new-home price rose 11% higher than last year at this time at $400,600. Inventory levels unexpectedly rose to 407,000 units. While inventory hit its highest level since 2008, over 90% of those homes haven’t been completed. Many didn’t begin construction, either.

Looking Ahead as the Federal Reserve Battles Inflation

After Powell tightened monetary policy, investors look for additional Fed guidance on the pace of future rate hikes and balance sheet reduction. In addition, investors seek further information on the coronavirus pandemic and the Russia-Ukraine situation.

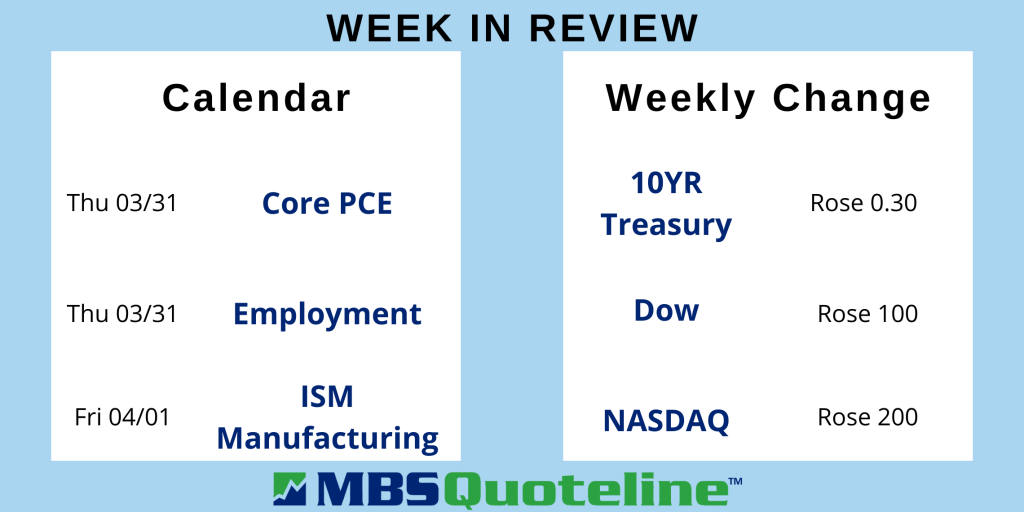

Beyond that, the core PCE price index, the inflation indicator favored by the Fed, comes out on Thursday. The key Employment report releases on Friday. These figures on the number of jobs, the unemployment rate, and wage inflation reflect the most highly anticipated economic data of the month.

As Powell tightened monetary policy, mortgage rates swiftly rose higher. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.