As the Federal Reserve remains aggressive against inflation, the new July CPI data showed a sharp decline. Overall, both forces influenced this week’s mortgage markets.

First, investors welcomed the lowed inflation numbers. However, the Federal Reserve’s tone felt abrasive to them. As a result, mortgage rates ended the week roughly unchanged.

Consumer Price Index Reveals Sharp Decline

Investors closely watch the Consumer Price Index (CPI) for inflation indications. CPI looks at price changes for a broad range of goods and services. In July, CPI rose 8.5% higher than a year ago. Despite the increase, CPI fell below the consensus forecast, down sharply from 9.1% last month.

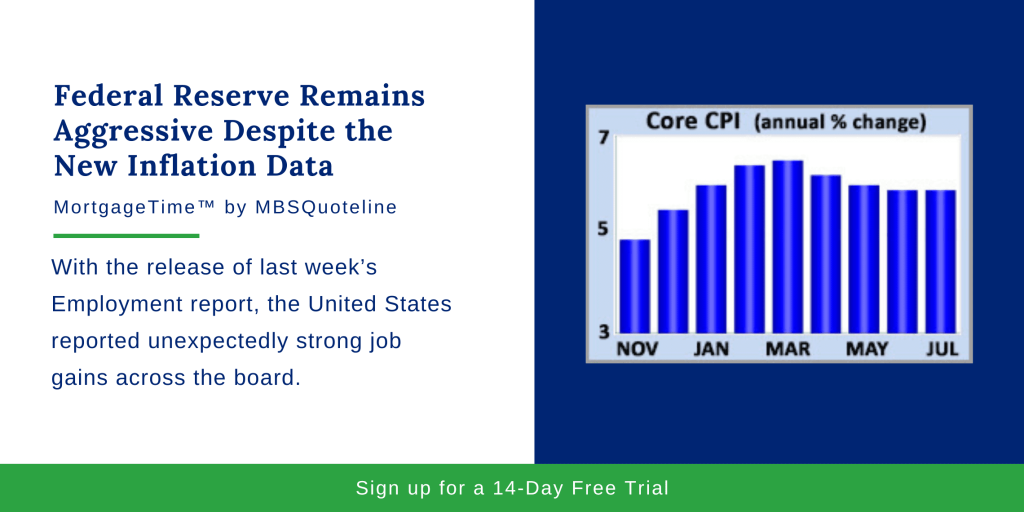

Core CPI excludes the volatile food and energy components. Also, Core CPI provides a clearer picture of the longer-term trend. In July, Core CPI climbed 5.9% higher than a year ago, also below the consensus forecast. In conclusion, Core CPI declined from a peak of 6.5% in March, the highest annual rate of increase since 1982. Although inflation saw a decrease, the Federal Reserve remains aggressive.

Reasons for Lower Inflation Figures

Below the surface, apparel prices, used vehicle prices, and airline fares posted declines in July. Housing costs, which represent 40% of core CPI, continued to climb significantly. Additionally, housing costs reflect changing market conditions more slowly than the other items in the index.

In other words, current housing costs often take a couple of extra months to pass through to the report due to measurement issues. Due to this lag, Federal Reserve officials remain aggressive as the PCE price index comes out later in the month.

Federal Reserve Remains Aggressive

While the inflation news was better than expected in July, the annual rate of Core CPI remained far above the readings around 2.0% seen early in 2021. Currently, the Federal Reserve remains aggressive with inflation, targeting that 2.0% level. Due to this, recent Federal Reserve comments indicated that they do not agree with the investor outlook for monetary policy next year. Officials and investors both anticipate additional rate hikes at the next few meetings. These rate hikes will increase the federal funds rate to around 3.50% by the end of the year.

At that point, Federal Reserve officials expect to either hold rates steady or raise them even more based on economic conditions. However, investors priced in rate cuts next year on the theory that a slowing economy will cause the Fed to shift back to supporting growth over fighting inflation. Since looser monetary policy is generally better for mortgage markets, these recent comments predicting a tighter path create an unfavorable reaction for mortgage rates.

Looking Ahead as Federal Reserve Remains Aggressive Against Inflation

As the Federal Reserve remains aggressive against inflation, investors watch for additional guidance. In particular, investors focus on the pace of future rate hikes and bond portfolio reduction.

Beyond that, Housing Starts come out on Tuesday. Retail Sales release on Wednesday. Consumer spending accounts for over two-thirds of U.S. economic activity. Thus, the retail sales data indicates economic health. Finally, Existing Home Sales publishes on Thursday.

As CPI fails to meet expectations and the Federal Reserve remains aggressive, mortgage rates ended the week unchanged. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.