With the August 2022 CPI report, investors fully understand the driving force behind climbing mortgage rates. Overall, the latest news shows unfavorable data.

In the highly anticipated CPI report, inflation rose much higher than expected. Thus, mortgage rates predictably climbed.

August 2022 CPI Report Exceeds Predicted Forecast

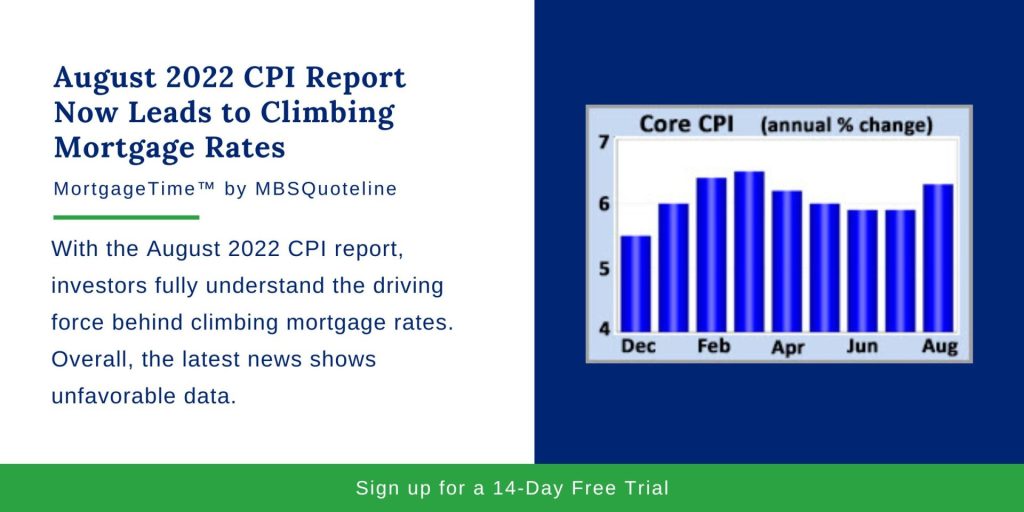

As a closely watched inflation indicator, the Consumer Price Index (CPI) looks at price changes for a broad range of goods and services. Taking a look at the latest data, the August 2022 CPI report increased 8.3% higher than a year ago, well above the consensus forecast of 8.0%. Core CPI excludes the volatile food and energy components and provides a clearer picture of the longer-term trend. In August 2022, Core CPI jumped 6.3% from a year ago, also far above the consensus forecast. Conclusively, this statistic nears the peak of 6.5% in March, the highest since 1982.

The Core CPI annual rate remains far above the readings around 2.0% seen early in 2021, the Fed’s stated target level. Food prices increased 11% higher than a year ago, and airline fares climbed an enormous 33% higher than last year at this time. To help bring down price increases, investors anticipate a 75-basis point increase (possibly 100 basis points) at the next Fed meeting.

Retail Sales and Mortgage Application Volumes

Aside from the August 2022 CPI report, the latest retail sales and mortgage application figures came out. Consumer spending accounts for over two-thirds of US economic activity. Therefore, consumer spending indicates economic health. In August, retail sales increased 0.3% from July, better than the consensus forecast for a slight decline. While the dollar value of gas sales fell due to lower gas prices, consumers use their savings to purchase other items. Of note, motor vehicle sales jumped a massive 2.8% from July. Spending at bars at restaurants rose a strong 1.1%. In contrast, sales at furniture stores posted significant declines.

Higher mortgage rates took a large toll on mortgage application volumes, now at the lowest levels in decades. According to the latest data from the Mortgage Bankers Association (MBA), average 30-year fixed rates roughly doubled what they were a year ago. Purchase applications decreased 29% from last year at this time. Finally, applications to refinance a loan plunged a shocking 83% from one year ago.

Looking Ahead After August 2022 CPI Report

After the publication of the August 2022 CPI report, the next Fed meeting takes place on Wednesday. Investors expect another large increase in the federal funds rate. Furthermore, investors hope for more specific guidance on the pace of future rate hikes and bond portfolio reduction.

In addition, Housing Starts release on Tuesday. Lastly, Existing Home Sales come out on Wednesday.

Although the European Central Bank raised interest rates to record levels, mortgage rates remained roughly unchanged. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.