Labor market strength is at the forefront of a week packed with major economic news, including daily volatility in mortgage markets. However, the two biggest events, the favorable Fed meeting and the unfavorably strong Employment report, were offsetting. Mortgage rates ended nearly unchanged.

Labor Market Strength Driving Rate Hikes

As expected, the Fed raised the federal funds rate on Wednesday by 25 basis points. Increased to the target range of 4.50% – 4.75%, the highest level since October 2007. During his press conference, Chair Powell remained firmly committed to fighting inflation. Powell explained that the tight labor market would keep upward pressure on wages and prices.

However, he later suggested that “a couple more rate hikes”. Implying that would probably get to the “appropriately restrictive” level necessary to bring down inflation. Fearing worse, investors generally would be pleased if additional rate hikes were limited to just 50 basis points. Powell also appeared to leave the door open to cutting rates before the end of the year. Of course, this is if inflation were to decline unexpectedly quickly.

517,000 Jobs Added to The Labor Market

With Fed officials closely watching for labor market tightness to ease, Powell’s caution seemed fully justified. When Friday’s Employment report came out, the economy gained a stunning 517,000 jobs in January, far exceeding the consensus forecast of just 185,000.

The gains were broad based with particular strength seen in leisure, hospitality, professional services, and health care. The unemployment rate unexpectedly fell from 3.5% to 3.4%, the lowest level since 1969.

Fed Fears Wage Growth in the Labor Market

Average hourly earnings, an indicator of wage growth, were 4.4% higher than a year ago, matching expectations. One of the few bright spots in the report from the Fed’s point of view is that this was the smallest annual rate of increase since August 2021.

The concern for Fed officials is that low unemployment will lead to larger and larger wage increases as companies compete for workers, causing greater inflationary pressures. While rare, strong job gains with just moderate wage increases would be an ideal outcome for the Fed.

2 Jobs for Every Worker

The JOLTS report measures job openings and labor turnover rates, and the latest data also indicated that the labor market remains very tight. At the end of December, there were a massive 11 million job openings, far above the consensus forecast, and over 4 million more than in January 2020 prior to the pandemic. There were 1.9 job openings for every unemployed worker, up from typical readings around 1.2 before the pandemic. A high level of openings reflects a strong labor market, as companies struggle to hire enough workers with the necessary skills. A very large number of employees also willingly left their jobs in December. Viewed as a sign of labor market strength as well, people usually quit only if they expect that they can find better jobs.

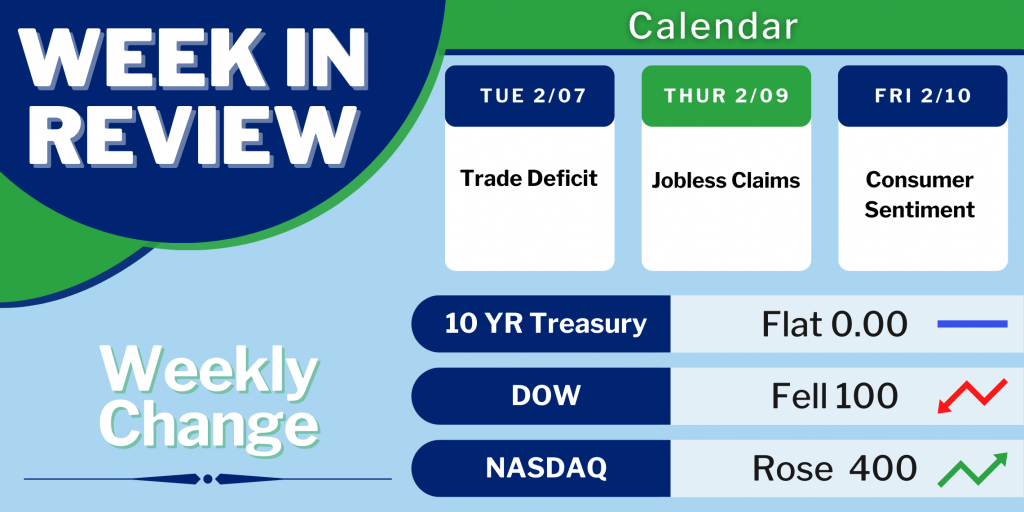

From feast to famine, at least there are no significant economic events scheduled for next week. Investors will be closely watching to see if Fed officials elaborate on their plans for future rate hikes. The economic reports released next week will include just the Trade Deficit, Jobless Claims, and Consumer Sentiment, which rarely cause much reaction. Investors will be mostly looking ahead to the important CPI inflation report on February 14th.

Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.