Following news surrounding the banking sector’s ongoing challenges, March mortgage-backed securities increased. With the fall of Silicon Valley Bank and UBS’ takeover of Credit Suisse, investors sought to shift their strategy.

As such, investors pivoted from “riskier” financial vehicles (like stocks) to relatively safer bonds. This generated a favorable gain for mortgage markets. As a result, mortgage rates ended the week lower.

March Mortgage-Backed Securities Rise Following Banking Sector Challenges

Due to the recent increase in March mortgage-backed securities coinciding with troubles in the banking industry, investors highly anticipated Wednesday’s Federal Reserve meeting. Primarily, investors contemplated how the Fed would balance its conflicting objectives of bringing down inflation (requiring tighter policy) and supporting the banks (requiring looser policy).

As expected by most investors, the Federal Reserve raised the federal funds rate by 25 basis points. Now, the target range falls between 4.75% to 5.00%, the highest level since September 2007. Furthermore, Fed officials project a terminal peak near 5.10%. Overall, the Fed anticipates one more 25 basis point hike before concluding this tightening cycle.

Beyond that, the Federal Reserve prioritized doing “whatever is necessary” to bring inflation back down to its target level of around 2.0% annually. Also, the Fed hopes to maintain stability in the banking system. In short, the Fed chose to preserve its flexibility in making future policy decisions. Finally, Chair Powell explained that banks would likely be more selective now, leading to fewer loans to businesses and consumers. According to Powell, it is too soon to tell how much tighter lending standards will slow economic growth, but it could “easily have a significant” effect.

Existing Home Sales Climb for the First Time in a Year

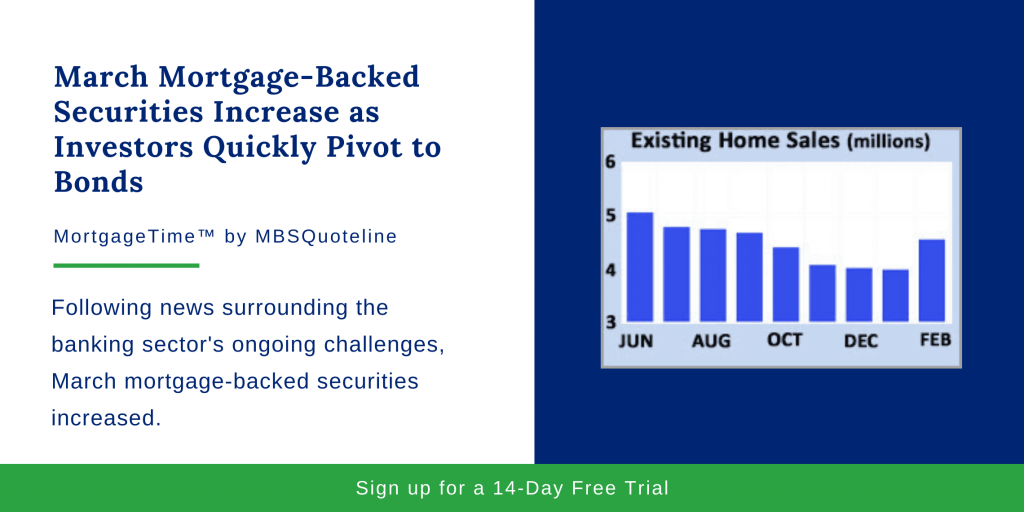

Aside from the March mortgage-backed securities data, sales of existing homes, which make up about 90% of the market, rose in February for the first time in twelve months, but were still 23% lower than last year at this time. Inventory levels remained a big trouble spot. While they were 15% higher than a year ago, they remained at just a 2.6-month supply nationally, far below the roughly 6.0-month supply which is typically seen in a balanced market.

After reaching a record high of $413,800 in June, the median existing-home price was down to $363,000. This was 0.2% lower than last February, the first annual price decline since 2012. New home sales, which account for the remaining 10% of the market, matched expectations with a small increase from January.

Looking Ahead After Latest Increase in March Mortgage-Backed Securities

After March mortgage-backed securities rose, investors keep a close eye on the banking sector to see if troubles spread to other institutions. More so, investors watch the Fed for future policy updates.

Next week contains light economic news. Consumer Confidence comes out on Tuesday. Personal Income and the core PCE price index, the inflation indicator favored by the Fed, release on Friday.

With ongoing news surrounding the banking sector, March mortgage-backed securities climbed. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.