As the U.S. realized weak labor market data, it saw job gains tailspin unexpectedly. The job gains data, alongside dovish central bank comments, left a favorable impact on mortgage rates.

While news on the trade negotiations with Mexico and China caused volatility, it created little net impact. Thus, mortgage rates ended at their lowest levels in about two years.

Job Gains Tailspin Unexpectedly

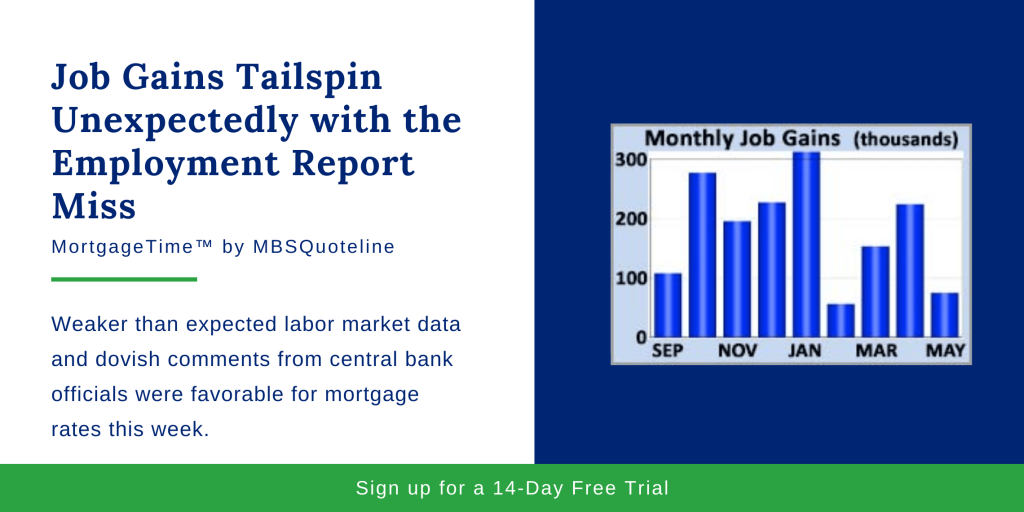

Friday’s highly anticipated monthly Employment report saw job gains tailspin unexpectedly, a significant downside miss. Against a consensus forecast of 180,000, the economy added just 75,000 jobs in May.

In addition, downward revisions subtracted 75,000 jobs from the results for prior months. Average hourly earnings, an indicator of wage growth, also fell short of expectations. However, they rose 3.1% higher than a year ago. Overall, this fell down from an annual growth rate of 3.2% last month.

Central Bank Comments

As job gains tailspin unexpectedly, Fed officials gave many speeches. Regarding future monetary policy, the Fed’s Bullard captured the prevailing sentiment that a rate cut “may be warranted soon”. This action stems from low levels of inflation and the risks to the economy from the ongoing trade disputes. Along with Friday’s labor market data, these comments reinforced the widely held view among investors. Investors believe that at least one rate cut takes place before the end of the year.

At Thursday’s meeting, the European Central Bank (ECB) edged toward looser monetary policy. To help stimulate economic activity, the ECB plans to hold rates at the current record low levels “at least through the first half of 2020”. Overall, this shifts from its prior guidance of “at least until the end of 2019.” The ECB outlook for European economic growth holds at just 1.2% this year and 1.4% in 2020. This contrasts with forecasted growth rates above 2.0% for the U.S. over the next couple of years.

Trade Volatility with Mexico

While job gains tailspin unexpectedly, trade produced tension with Mexico. On the trade front, investors focused more on Mexico than China. Following last Friday’s unexpected threat by the Trump administration to impose a 5% tariff on all imports from Mexico beginning June 10, the two sides failed to reach an agreement.

However, many sources indicate that substantial progress has been made. Most investors expect a tariff delay. Regarding China, little news came in this week.

Looking Ahead After Job Gains Tailspin Unexpectedly

After job gains tailspin unexpectedly, investors look towards Wednesday’s Consumer Price Index (CPI) report. They widely follow CPI as an inflation indicator. CPI looks at the price change for goods and services.

Later, Retail Sales release on Friday. Consumer spending accounts for about 70% of all economic activity in the U.S. Therefore, the retail sales data indicates growth. In addition, Treasury auctions on Wednesday and Thursday hold influence over mortgage rates.

Want to see how mortgage-backed securities fluctuate when job gains tailspin unexpectedly? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.