After a large decline in 2019 to the lowest levels in several years, mortgage rates reversed the trend. Overall, strong economic data, reduced trade tensions, and a mixed message from European Central Bank (ECB) officials led to a changing of the tide. Thus, mortgage rates faced a negative impact.

Retail Sales & CPI Lead Mortgage Rates to Reverse Trends

As mortgage rates reverse trends, two of the most important inciting reports came from retail sales and CPI. First, the manufacturing sector took a hit from increased tariffs and other barriers to trade. However, Friday’s data confirmed that U.S. consumer spending has remained strong.

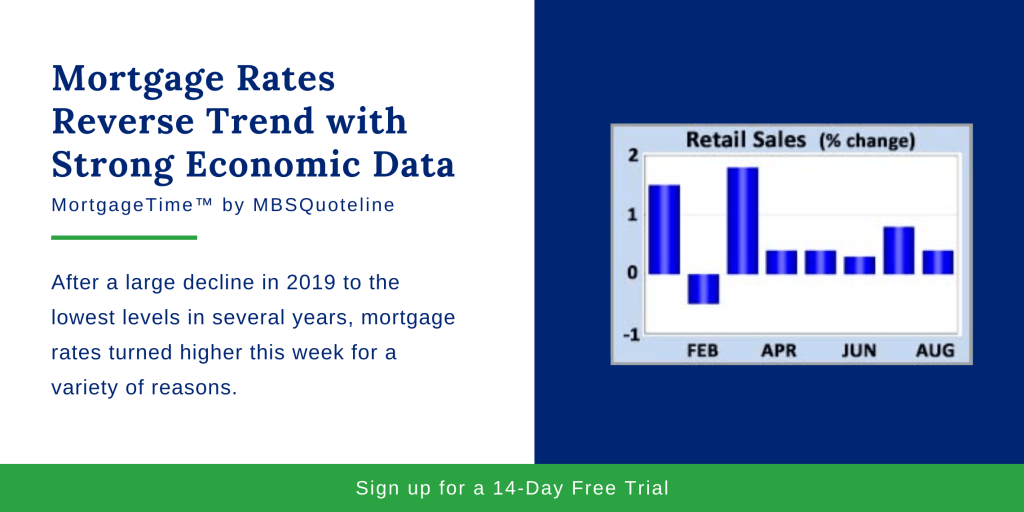

In August, Retail Sales rose 0.4% from July, double the consensus for an increase of just 0.2%. This marked the sixth straight month of solid gains. Supported by a healthy labor market, consumers showed few signs of slowing heading into the important holiday shopping season.

Also, this week’s inflation data exceeded expectations. In August, the Core CPI price index, which excludes the volatile food and energy components, increased 2.4% higher than a year ago. Not only did this improve from an annual rate of increase of 2.2% last month, it matched the highest level since 2008.

Trade

The latest trade developments also helped mortgage rates reverse trends. Finally, the United States and China suggested an increased willingness to work together to reach a mutually beneficial deal. United States and Chinese officials announced that the imposition of some proposed new tariffs will be delayed.

Additionally, the Trump administration considers an interim trade deal which would modestly scale back some tariffs while lengthier negotiations on a more comprehensive agreement continued. The next round of trade talks takes place early in October. Since a reduction in trade restrictions encourages global economic activity, these developments reflected negatively for mortgage rates.

European Central Bank

Counterintuitive to mortgage rates reversing trends, Thursday’s announcement from the European Central Bank (ECB) demonstrates one of the few pieces of good news for mortgage rates this week. That said, its effect was mostly reversed later in the day following less favorable comments from ECB officials.

To help stimulate economic growth, the ECB cut rates and announced that it will resume a bond buying program which had ended in December. According to its statement, the ECB will purchase 20 billion euros per month of eurozone debt for “as long as necessary.” This aggressive monetary easing initially pushed global bond yields lower, but it was later reported that many officials were in favor of smaller policy changes.

Looking Ahead After Mortgage Rates Reverse Trends

As mortgage rates reverse the trend, investors look towards the next United States Federal Reserve Meeting. Thus, the meeting takes place on Wednesday. Most investors expect a 25 basis point rate cut. However, forecasts vary widely on what the Fed will signal about the outlook for future policy.

Aside from the Fed meeting, the housing sector provides most of next week’s primary economic data. Housing Starts release on Wednesday. Existing Home Sales come out on Friday. In addition, news about the trade negotiations hold influence over mortgage rates.

As mortgage rates reverse trends, they climbed after hitting record-low levels. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.