Holding plenty of influence over mortgage rates, the United States-China trade talks face hurdles. However, they generated a favorable impact this time.

On the economic front, the latest data neared expected levels. Thus, the reports caused little reaction. As a result, rates ended the week lower.

Trade Talks Face Hurdles

Last week, it seemed like the U.S. and China neared the signature portion for phase one of the trade agreement. Reportedly, phase one contains easier concessions for both sides. Now, the trade talks face hurdles.

As both sides drag their feet over the deal terms, China shows apprehension towards purchasing specific levels of agricultural products from the United States. On the other hand, the United States seeks better protection of intellectual property. Because the continual tariffs slowed global economic activity, the lack of progress reflected positively for mortgage rates.

Consumer Spending Rebounded from Slowdown

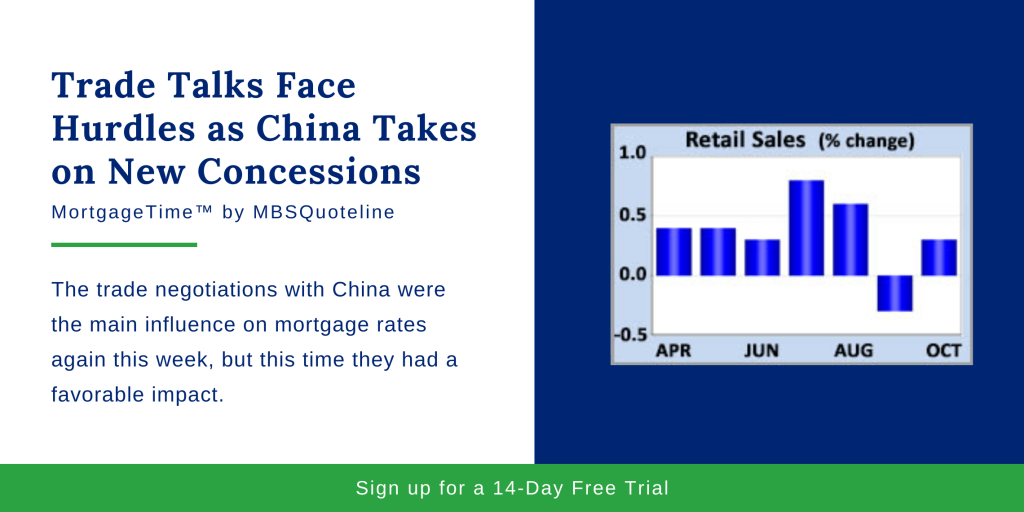

While the trade talks face hurdles, Friday’s Retail Sales report revealed that consumer spending rebounded from last month’s slowdown. Heading into the holiday season, Retail Sales rose a solid 0.3% from September to October. Not only is this stronger than expected, Retail Sales increased 3.1% from the prior year. Analysts credit the increase to the rise of online shopping activity.

Also, the latest Core CPI report indicated an easement of inflation from last month. In October Core CPI rose 2.3% higher than a year, down from an annual rate of increase of 2.4% in September. In testimony to Congress this week, Chair Powell didn’t change the Fed’s recent message that monetary policy likely is on hold for a while. Powell said that there will be no further rate adjustments if the economy performs as expected with modest growth and inflation near the Fed’s target level.

Looking Ahead as Trade Talks Face Hurdles

As the trade talks face hurdles, investors look towards Tuesday’s Housing Starts report. Additionally, the October 30th Federal Reserve meeting minutes publish on Wednesday. Holistically, the detailed minutes shed light into the debate between Fed officials about future monetary policy. Also, the minutes may move markets.

Finally, Existing Home Sales release on Thursday. Aside from reporting, investors look towards news on the trade negotiations for the latest mortgage market influence.

As trade talks face hurdles, mortgage rates declined this week. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.