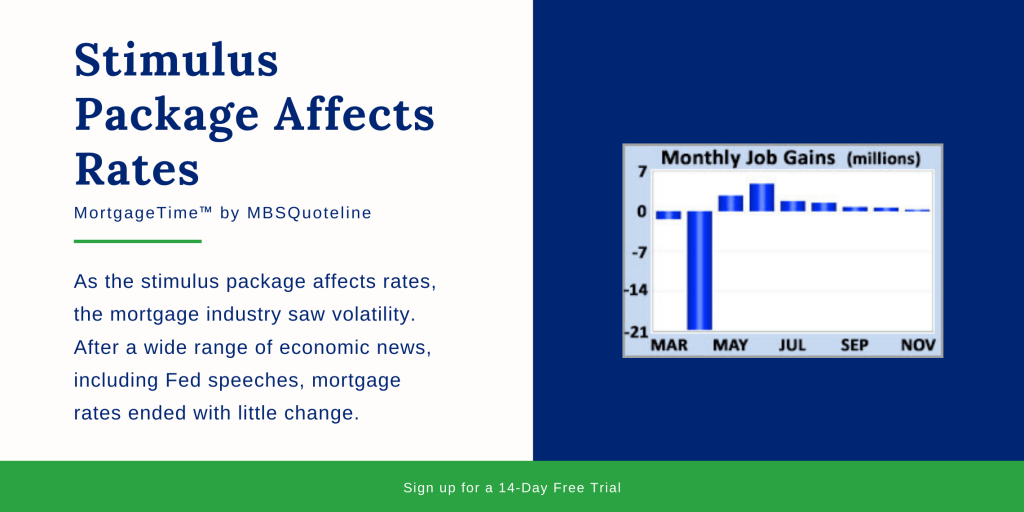

As the stimulus package affects rates, the mortgage industry saw volatility. After a wide range of economic news, including Fed speeches, mortgage rates ended with little change.

However, the net effects of a proposed new stimulus package, Fed speeches, and disappointing consumer spending data were roughly offsetting, and mortgage rates ended with little change.

Stimulus Package Affects Rates

On Thursday, President-elect Joe Biden released the details of a $1.9 trillion coronavirus rescue package. The new stimulus package assists households and businesses during the pandemic.

Some elements of the proposal include additional direct payments of $1,400 to most Americans. It also increases unemployment benefits and the minimum wage. Lastly, the proposed stimulus package extends eviction and foreclosure moratoriums until the end of September.

If passed, the Fed will probably issue additional bonds to fund spending. As a result, the stimulus package affects rates in a negative way.

COVID-19 Impact on the Economy

Consumer spending declined sharply this past spring. Following declines, consumer spending bounced back remarkably. It quickly reached record levels.

However, rising COVID-19 case counts caused three straight months of declines. In December, retail sales dropped 0.7%. This was down from November’s statistic. Also, the November retail sales were revised lower as well.

Reduced economic activity caused a decline in inflation due to the coronavirus pandemic. The latest report confirmed that levels remain low.

Overall, the Consumer Price Index (CPI) is a widely followed monthly inflation report. CPI looks at the price change for goods and services. In December, core CPI was 1.6% higher than a year ago. This is the same annual rate of increase as last month.

Fed Speeches This Week

Several Fed officials gave speeches this week, and their basic message was consistent. As was stated in the most recent policy statement, officials plan to keep an accommodative stance until there is “substantial further progress” toward their employment and inflation goals. According to Chair Powell on Thursday, raising the federal funds rate will not take place any time soon. Essentially, there will be no reason to tighten monetary policy unless inflation rises substantially “in ways that are unwelcome.”

Looking Ahead After Stimulus Package Affects Rates

Looking ahead, investors will continue watching COVID-19 case counts and vaccine distribution. Beyond that, it will be a light week for economic data which will feature the housing sector.

Housing Starts will be released on Thursday and Existing Home Sales on Friday. Mortgage markets are closed on Monday for Martin Luther King Jr. Day.

Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.