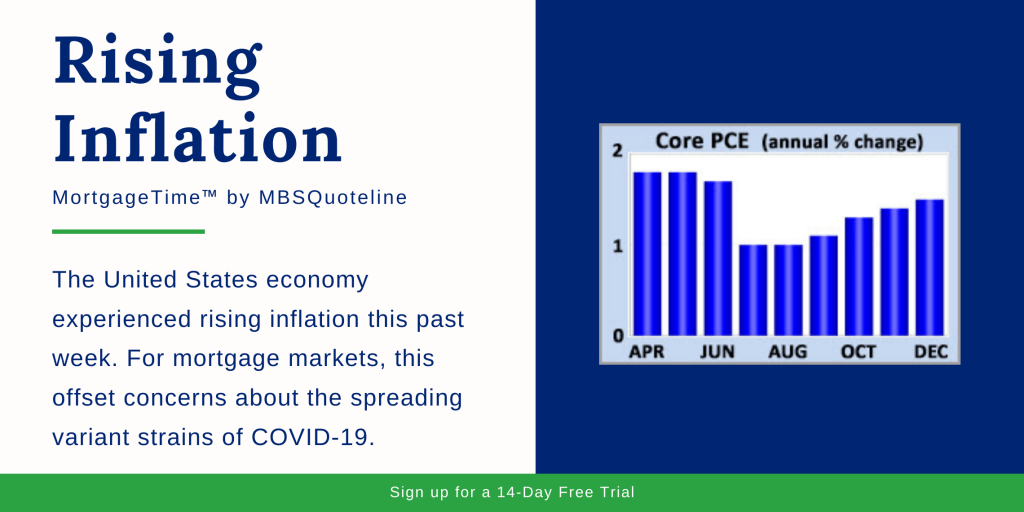

The United States economy experienced rising inflation this past week. For the mortgage-backed securities marketplace, this offset concerns about the spreading variant strains of COVID-19.

Wednesday’s Fed meeting produced no surprises. The reaction was minor. As a result, mortgage rates ended the week with little change.

Rising Inflation

MBSQuoteline has continually monitored how the coronavirus pandemic affected the United States economy. Overall, the pandemic led to reduced economic activity. This, in turn, sparked a decline in inflation, one of the factors responsible for record-low-mortgage rates.

However, investors are now concerned about this trend reversing. Ultimately, the United States economy may be seeing rising inflation.

In December, the core PCE price index was 1.5% higher than a year ago. This metric was well above the consensus forecast. It was also up from an annual rate of increase of 1.4% last month.

GDP Returning to Normal Growth Levels

Gross domestic product (GDP) represents the broadest measure of economic activity regardless of the rising inflation. After enormous swings due to the pandemic, (GDP) appears to be returning to more normal growth levels. GDP declined a stunning 31% annualized during the second quarter of 2020.

Then, GDP increased at a comparable rate of 33% annualized during the third quarter. By contrast, fourth-quarter GDP growth was 4.3% annualized, which was close to expectations, and more in line with historical readings.

Fed Updates on Bond Purchase Program

As expected, the Fed made no changes in the federal funds rate in spite of the rising inflation. In addition, the Fed did not change its massive bond purchase program either. The meeting statement was remarkably similar to the prior one.

Officials noted that after a “sharp rebound” in economic activity over the summer, growth has “moderated in recent months.”

There was no additional guidance on the magnitude or the duration of future bond purchases. The Fed intends to continue its highly accommodative monetary policy until they achieve their goals for unemployment and inflation.

Looking Ahead After Rising Inflation

Looking ahead after the rising inflation, investors will continue watching COVID-19 case counts and vaccine distribution.

Today, the ISM national manufacturing index will be released. The ISM national services index will go out on Wednesday.

Finally, the monthly employment report will be released on Friday. This report represents the most highly anticipated economic data of the month, including figures on the number of jobs, the unemployment rate, and wage inflation.

Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.