This past week saw an informative ECB meeting and Fed report, indicating the best mortgage rate outcome heading into summer 2021. Despite a stronger than expected inflation report, investors focused elsewhere.

Overall, the European Central Bank meeting provided a favorable result. Thus, mortgage rates ended the week a little lower.

Informative ECB Meeting & Federal Reserve Report

Thursday saw an informative ECB meeting. During the meeting, the European Central Bank (ECB) made no policy changes. Conclusively, the lack of change reflects the best-case outcome for mortgage rates.

Simultaneously, the ECB made no mention of a specific time frame for starting to scale back its bond purchase program. For analysts, the meeting statement tone felt relatively dovish. Investors widely expect that the ECB tightens monetary policy rather than to loosen it. For now, holding steady exemplifies positive news.

Meanwhile, the Federal Reserve reported that household net worth at the end of the first quarter of 2021 soared 3.8% higher than at the end of 2020. Roughly $3.2 trillion of gains originated from stocks. Aside from stocks, $1.0 trillion stemmed from increased real estate values.

Core CPI Improves

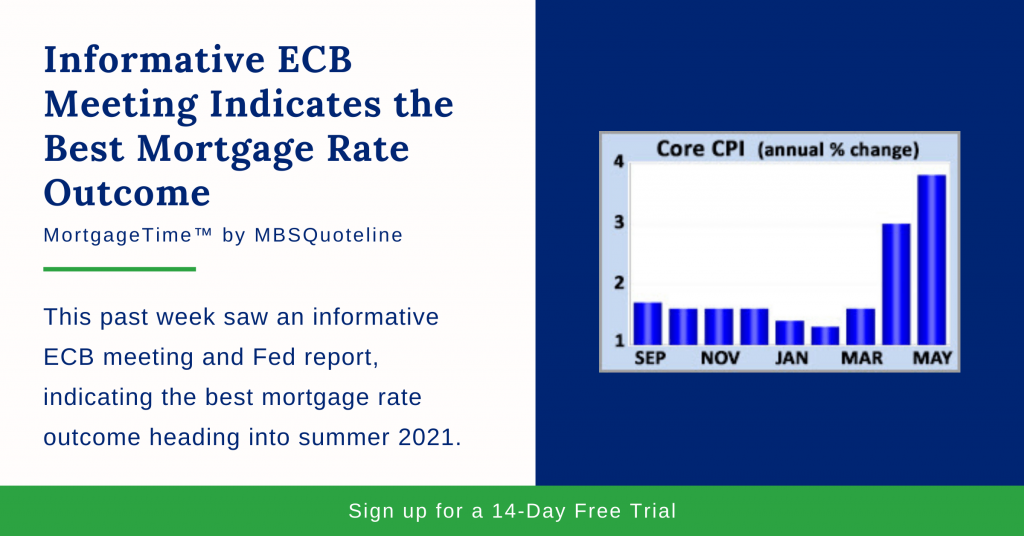

Aside from the informative ECB meeting, the Consumer Price Index report came out. Analysts widely follow the Consumer Price Index (CPI). As a monthly inflation report, CPI looks at the price change for goods and services.

Core CPI excludes the volatile food and energy components. In May 2021, core CPI jumped 0.7% from April. This statistic exceeded the consensus forecast of just 0.5%. Core CPI realized large increases in prices used for cars and airline tickets.

In addition, core CPI rose 3.8% higher than a year ago. This improved from April’s 3.0% annual rate of increase. Also, core CPI saw its highest reading since 1992.

Now, analysts wonder whether this is caused by temporary factors or long-term influences.

JOLTS Report Reflects Labor Market Strength

Comprehensively, the informative ECB meeting, Federal Reserve report, core CPI, and JOLTS data indicate that the economy is rapidly improving. The JOLTS report measures job openings and labor turnover rates. That said, the latest data indicates that the labor market is tightening.

At the end of April 2021, job openings unexpectedly surged to 9.3 million. In conclusion, April job openings shattered the former record high.

Currently, there are more than two million higher job openings than there were in January 2020. Of course, the coronavirus pandemic occurred after January 2020. Ultimately, high levels of job openings reflect a strong labor market. However, this also displays companies’ inability to hire enough workers.

Also, countless employees willingly left their jobs in April. Analysts consider this a sign of labor market strength. Usually, people quit only if they expect to find better opportunities.

Looking Ahead After the Informative ECB Meeting

Looking ahead after the informative ECB meeting, investors continue watching global COVID-19 case counts and vaccine distribution. In terms of reports, housing starts comes out on Wednesday.

Beyond that, the next Fed meeting takes place on Wednesday. Analysts do not expect a change in the federal funds rate. However, investors look for detailed guidance on the pace of future bond purchases.

In addition, the latest retail sales data releases on Tuesday. Consumer spending accounts for over two-thirds of U.S. economic activity. Because of this the retail sales represents a key indicator for economic strength.

Want to see how the informative ECB meeting affects mortgage-backed securities? Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.