Last week, mortgage markets experienced daily volatility as the Russia-Ukraine conflict led to soaring demand for mortgage-backed securities. As Russia and Ukraine continued their cat-and-mouse dynamic, investor expectations shifted constantly.

Despite all of the action, the daily movements offset one another. Thus, mortgage rates ended the week with little change. However, mortgage rates remain at their highest levels since mid-2019.

Russia-Ukraine Conflict Drives Shift to MBS

In response to this week’s geopolitical events, such as the ongoing Russia-Ukraine conflict, investors generally seek to reduce their risk level. As the latest news indicated a greater chance of Russian military action, investors shifted from stocks to safer assets.

In doing so, bonds became very popular over the past week. This increased demand for mortgage-backed securities (MBS) left a favorable impact on mortgage rates. On the other hand, any news hinting at reduced tensions created the opposite effect.

Consumer Spending Exceeds Forecast

Aside from the Russia-Ukraine conflict, consumer spending pleasantly surprised investors. Overall, consumer spending accounts for over two-thirds of the United States’ economic activity. Therefore, consumer spending indicates the country’s economic health.

In January 2022, retail sales jumped 3.8% from December. This result climbed far above the consensus forecast for an increase of 2.0%. Conclusively, the gains distributed broadly, in vehicles, furniture, and building materials.

Existing Home Sales & Prices Jumped Alongside Limited Inventory

After unexpectedly dropping in December, sales of existing homes jumped 7% in January, far above the consensus forecast for just a slight increase. Inventory levels in January declined 17% from a year ago. Remaining at just a 1.6-month supply nationally, housing inventory reached a record-low, falling well below the 6-month supply (a healthy balance between buyers and sellers). Due to the low inventory, the median existing-home price increased 15% higher than last year at this time at $350,300.

With the shortage of available homes in many areas, investors closely watched the monthly reports on housing starts, and the most recent data contained mixed results. In January, housing starts unexpectedly decreased 4% from December. However, building permits, a leading indicator of future activity, unexpectedly beat the consensus forecast, rising to the highest level since 2006. Higher prices and shortages for land, materials, and skilled labor remained obstacles to a faster pace of construction.

Looking Ahead Towards the Ongoing Russia-Ukraine Conflict

As the Russia-Ukraine conflict progresses, investors closely look for any additional updates. Also, investors still follow the Federal Reserve updates in hopes for guidance on the pace of future rate hikes and balance sheet reduction.

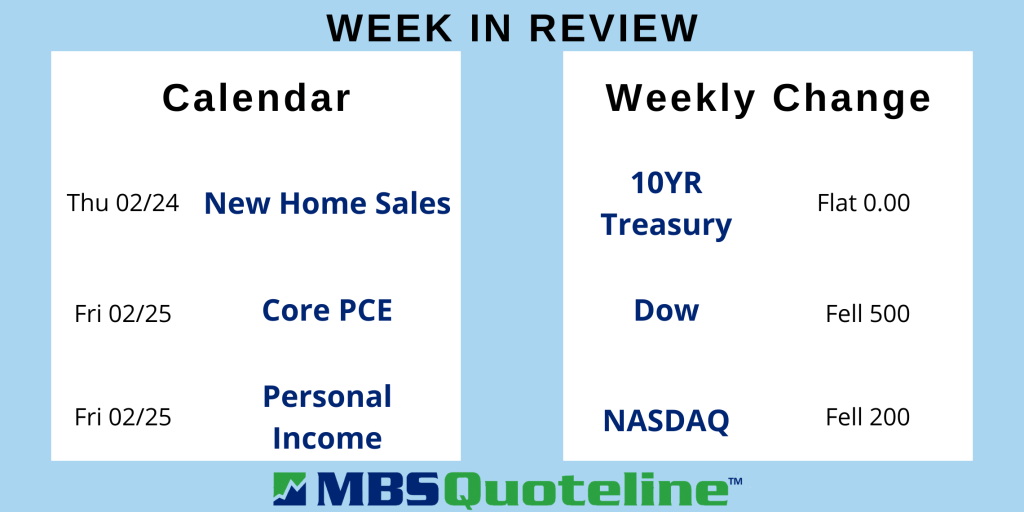

Next week, mortgage markets close on Monday in observance of Presidents Day. Beyond that, New Home Sales releases on Thursday. Finally, the core PCE price index, the inflation indicator favored by the Fed, publishes on Friday.

Following the latest news on the Russia-Ukraine conflict, mortgage rates hover at their highest point since the middle of 2019. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.