Although this week’s Federal Reserve meeting revealed no surprises, the Fed launched its 75-basis point increase. Notably, this federal funds rate hike matches the largest since 1994.

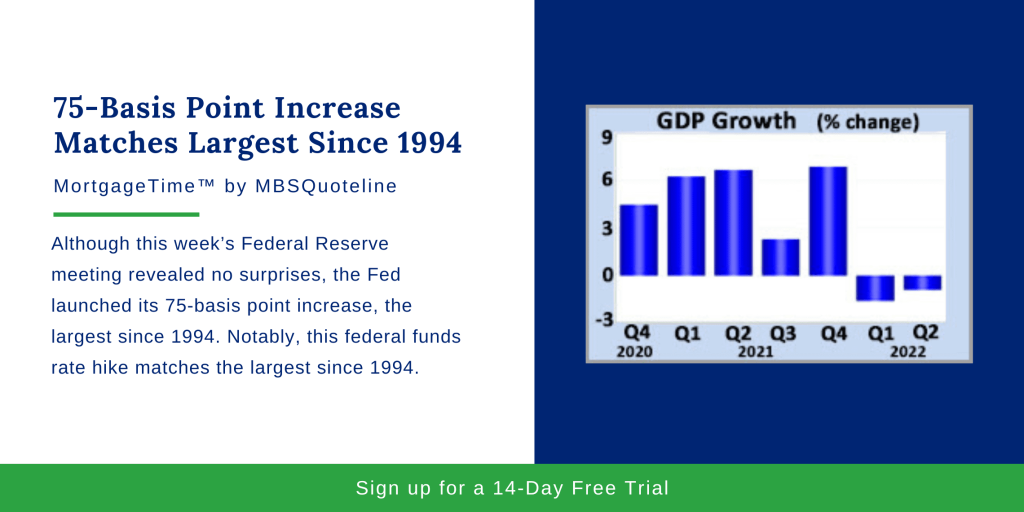

In terms of economic growth, the latest Gross Domestic Product (GDP) report came in weaker than expected. In conclusion, this sparked a favorable impact for mortgage markets, leading to slight decline in rates by the end of the week.

Federal Reserve Announces 75-Basis Point Increase

As expected, the Federal Reserve announced a 75-basis point increase at Wednesday’s meeting, matching the largest increase since the last meeting and 1994. With this latest news, investors anticipated further increases to the federal funds rate. In addition, neither the meeting statement nor Chair Powell’s comments during the press conference revealed any unexpected shift in policy.

However, officials plan to evaluate incoming economic data to determine the size of rate hikes going forward. Overall, this means that investors should no longer count on receiving precise guidance in advance. Now, investors split about whether there will be an increase of 50 or 75-basis points at September’s meeting.

GDP Falls Below While PCE Rises Above the Consensus

Aside from the 75-basis point increase, this week saw the release of the latest GDP and PCE price index reports. First, GDP fell at an annualized rate of 0.9% during the second quarter, well below the consensus forecast for an increase of 0.5%, but an improvement from a decline of 1.6% during the first quarter. Analysts attribute the shortfall to inventories, private investment, and government spending. Worth noting, consumer spending on goods also declined, but this was more than offset by increased spending on services.

As for the core PCE price index, it climbed in June, up 4.8% from a year ago. Also, core PCE rose a little from 4.7% in May 2022. For comparison, the annual rate of increase fell below 2.0% during the first three months of 2021. Currently, investors question the long-term prognosis of inflation, the COVID-19 pandemic, and the Russia-Ukraine War.

Looking Ahead After 75-Basis Point Increase

After the Federal Reserve initiated another 75-basis point increase, investors look for additional Fed guidance on the pace of future rate hikes. Also, investors seek insights into the Fed’s bond portfolio reduction strategy.

Next week, the ISM national manufacturing sector index comes out on Monday. Later, the ISM national services sector index publishes on Wednesday. Beyond that, the key Employment report releases on Friday. Holistically, the monthly Employment report represents highest anticipated economic data of the month.

With the Federal Reserve launching its second 75-basis point increase of 2022, mortgage rates declined slightly by the end of the week. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.