While this week’s Jackson Hole Economic Symposium failed to cause much reaction, mortgage rates ended the week a little higher. However, Federal Reserve Chair Jerome Powell’s speak did allude to greater inflation consequences.

Jackson Hole Economic Symposium Alludes to “Some Pain”

In a highly anticipated speech from the Jackson Hole Economic Symposium, Fed Chair Powell alluded to the inflation outlook. In his address, Powell mentioned that the consequences of not aggressively fighting inflation produce a worse scenario than the effects of tightening monetary policy. Overall, he said that tightening monetary policy includes “some pain” for households and businesses.

Powell repeated that future decisions depend on incoming economic data. Despite that announcement, he chose not to include specific guidance. Investors remain divided about whether the Fed raises the federal funds rate by 50 or 75 basis points at the September 21st meeting.

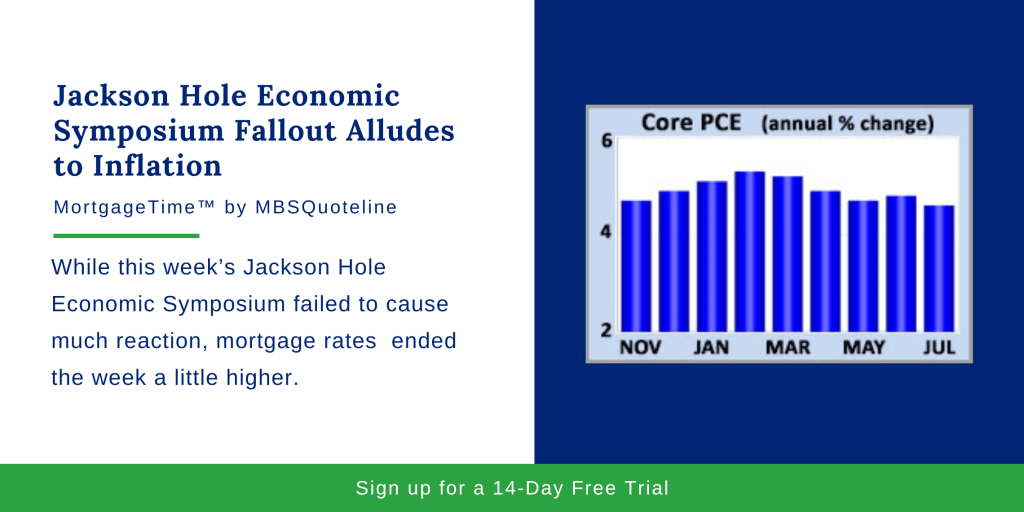

Core PCE Climbs but Falls Below Consensus Forecast

As the Jackson Hole Economic Symposium pointed towards inflation, core PCE climbed slightly year-over-year. In July 2022, core PCE increased 4.6% from a year ago. Not only did this fall below the consensus forecast, core PCE declined from a peak of 5.3% in February.

As the Federal Reserve’s preferred inflation indicator, the PCE price index The PCE price index provides direct insights into the country’s economic future. For comparison, the annual rate of increase decreased below the Fed’s target level of 2.0% during the first three months of 2021. Now, investors question how quickly monetary policy will lower inflation.

Mortgage Rates Present Obstacle for Housing Market Activity

While the Jackson Hole Economic Symposium addressed inflation, higher mortgage rates represent continual evidence of it. Furthermore, mortgage rates remain an obstacle for housing market activity. Sales of new homes peaked in January 2021 at an annualized rate of 993,000.

In July, new home sales fell 13% from June to just 511,000, along with plummeting to their lowest level since January 2016, new home sales plunged a shocking 30% lower than last year at this time. The median price of a new home grew 8% higher than a year ago, reaching $439,400. As a result of rising prices and mortgage rates, the cancellation rate for contracts to purchase new homes surged in recent months.

Looking Ahead After Jackson Hole Economic Symposium

After this week’s Jackson Hole Economic Symposium, investors watch for additional Fed guidance on the pace of future rate hikes. Also, investors seek insight into the Fed’s bond portfolio reduction strategy.

Beyond that, the ISM national manufacturing sector index comes out on Thursday. The key Employment report releases on Friday. Holistically, the monthly Employment report entails figures on the number of jobs, the unemployment rate, and wage inflation reflects be the most highly anticipated economic data of the month.

With the Jackson Hole Economic Symposium, mortgage rates increased slightly towards the end of the week. Never miss an update with MBSQuoteline. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.