This week, mortgage-backed securities dropped as consumer spending data fell short. Meanwhile, the inflation data matched expectations.

Overall, neither report contained much lasting impact. As a result, mortgage rates ended the week slightly higher.

Mortgage-Backed Securities Dropped with Latest Economic Data

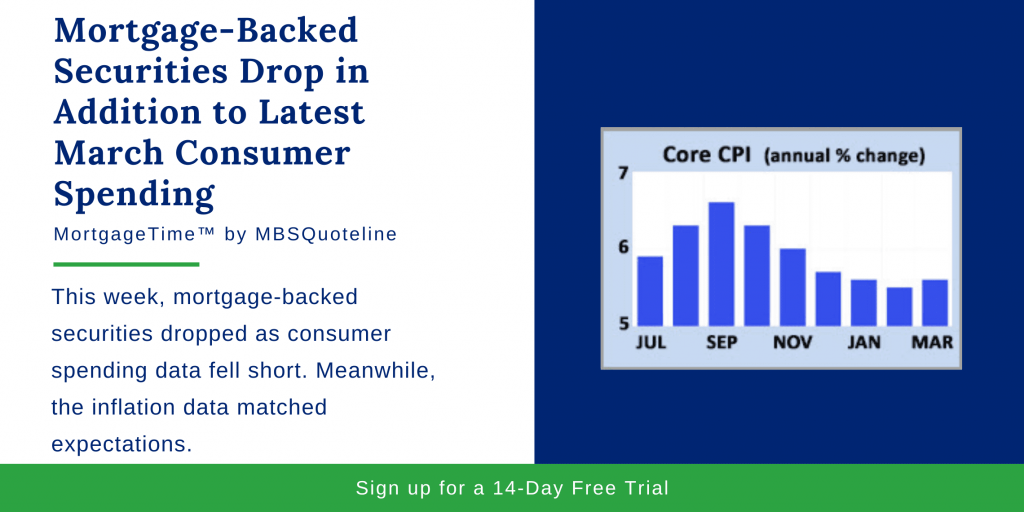

As this week’s round of economic reports came out, markets saw mortgage-backed securities drop. First, the latest key inflation data came in very close to expectations. Analysts and investors closely watch the Core Consumer Price Index (CPI) as an inflation indicator because it excludes the volatile food and energy components. In March 2023, Core CPI rose 5.6% higher than a year ago, up from an annual rate of increase of 5.5% last month.

While the annual rate of increase in Core CPI fell from a peak of 6.6% in September, it remains far above the readings around 2.0% seen early in 2021 (the Fed’s target). Since overall inflation remains elevated, it is not surprising that the majority of individual components continued to show significant price increases. In particular, shelter costs remained stubbornly high and again were responsible for the largest portion of the increase. However, there were interesting exceptions. For instance, used car prices declined 12% year-over-year.

Retail Sales Plunged 1% from February 2023

Second, the Retail Sales report on Friday received a great deal of attention. Holistically, consumer spending accounts for over two-thirds of United States economic activity. In March, retail sales plunged 1.0% from February, far worse than the consensus for a decline of 0.5%. This contributed to the mortgage-backed securities drop.

In general, consumers spent more on groceries, while cutting back on autos, furniture, appliances, and building materials. Smaller tax refunds than last year due to a pullback in pandemic-related tax breaks may have been one factor for weakness in spending in March.

March Federal Reserve Meeting Minutes Provide No Surprises

Generating minor impact as mortgage-backed securities dropped, the March 2023 Federal Reserve meeting minutes provided no surprises. However, they shared additional insight into recent banking challenges. Officials faced a tightwire act trying to balance their conflicting objectives of bringing down inflation (requiring tighter policy) and helping support the banks (requiring looser policy).

According to the minutes, banks will be more selective now, leading to fewer loans to businesses and consumers. This will slow economic activity and reduce future inflationary pressures, but the its impact is extremely difficult to predict. Investors debate whether the Fed will raise the federal funds rate by an additional 25-basis points at the next meeting on May 3 or hold them steady.

Looking Ahead After Mortgage-Backed Securities Dropped

After mortgage-backed securities dropped, investors continue to keep a close eye on the banking sector for signs that troubles are spreading to other institutions. Also, they watch to see if Fed officials elaborate on their plans for future monetary policy.

Next week contains light economic reporting. That said, the focus shifts to the housing sector. On Tuesday, Housing Starts come out. Later, Existing Home Sales figures publish on Thursday.

As mortgage-backed securities dropped, mortgage rates rose by the end of the week. To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days.

Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.