If you don’t find what you’re looking for within our Frequently Asked Questions (FAQ’s), please feel free to contact us. We look forward to serving you.

Common FAQ’s

Bronze – Personalized weekly newsletter to market to clients, Realtors, and other referral sources

Silver – Bronze plan plus real-time MBS market updates and alerts via email and text

Gold – Silver plan plus access to our website (live prices, analysis, charting, events calendar, & much more) from all devices

Platinum – Gold plan plus forward months and live GNII prices (designed for secondary)

Contact us for pricing.

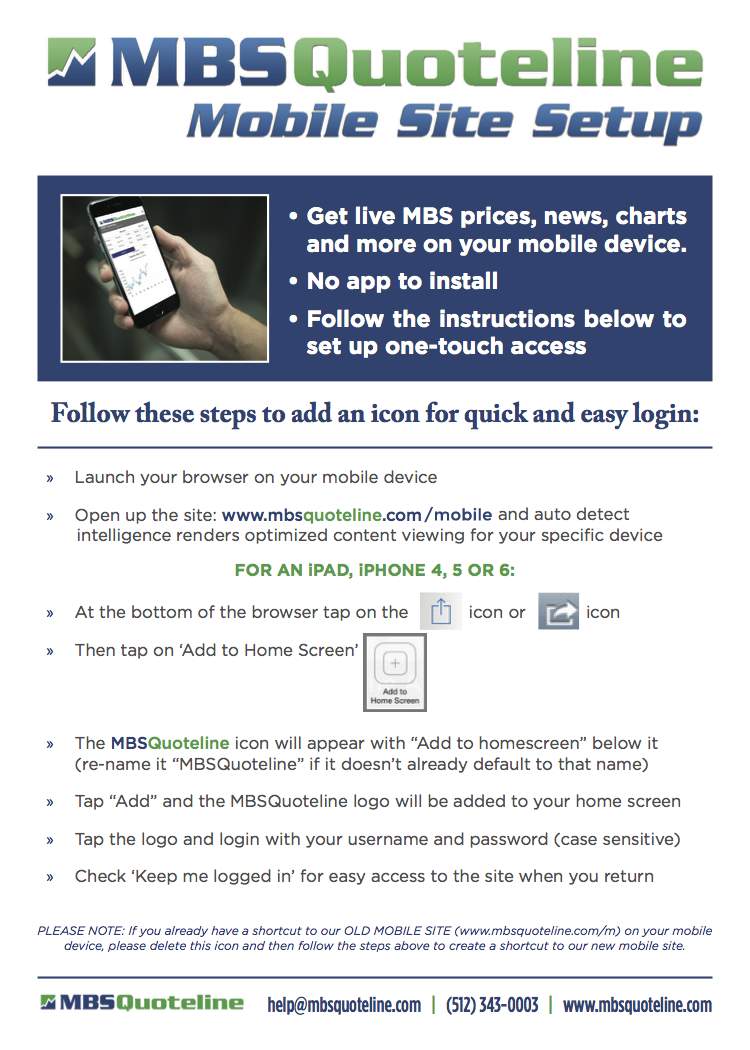

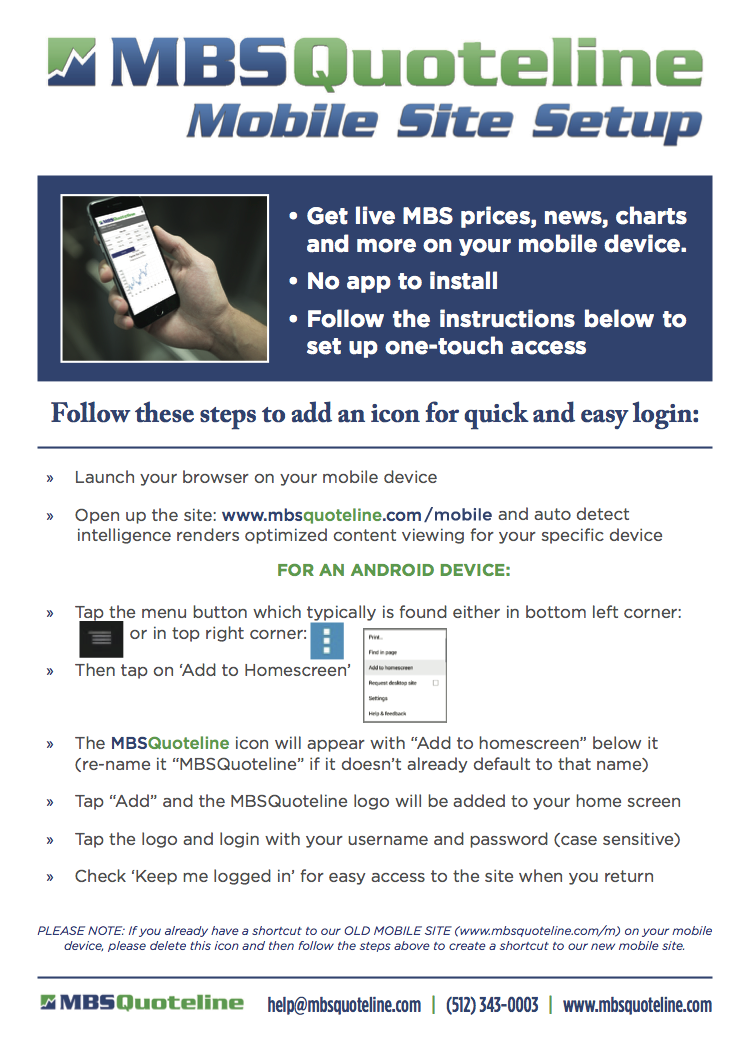

Yes. Simply enter www.mbsquoteline.com from your mobile device and our auto detect intelligence will render optimized viewing of the mobile version of our web site. Enter the same user name and password as you use for the desktop version to log in. Tap the button to load an MBSQuoteline icon to your home screen and activate the Keep Me Logged In feature. After these steps are completed, future access to live prices and other market information on your mobile device is just a tap of the icon and a tap to log in.

Help FAQ’s

Internet Explorer 9

Firefox 36

Safari 5.1

Chrome 37

Browser Recommendations:

Internet Explorer 11

Firefox 36

Safari 7

Chrome 40

To enable cookies using Internet Explorer in your browser window, go to top and click on Tools -> Internet Options -> go to the “Privacy” tab -> Click on Advanced. In the “Cookies” window select “Accept” in the First party Cookies and check Always Allow Session Cookies. We recommend you select “Block” for Third Party Cookies.

Safari users Tap Settings -> Safari -> Privacy & Security and verify/edit: BLOCK COOKIES should be set to ‘Always Allow’ and PASSWORDS & AUTOFILL Names and Passwords should be set to ‘On’.

Google Chrome users go to Chrome menu icon -> Settings -> Show advanced settings -> in the Privacy” section, select Content settings -> Select Allow local data to be set (recommended) -> Select Done

Cookies are enabled by default with newer versions of Firefox. To check or change your settings go to the menu button -> Options -> Privacy -> Choose “Use custom settings for history” -> Check Accept cookies from sites -> Check ‘Always’ Accept third-party cookies -> Select Keep Until “they expire” -> close the window and any changes you made will automatically be saved.

Mobile Access FAQ’s

Yes. Simply enter www.mbsquoteline.com from your mobile device and our auto detect intelligence will render optimized viewing of the mobile version of our web site. Enter the same user name and password as you use for the desktop version to log in. Tap the button to load an MBSQuoteline icon to your home screen and activate the Keep Me Logged In feature. After these steps are completed, future access to live prices and other market information on your mobile device is just a tap of the icon and a tap to log in.

At the bottom of each page on the mobile site you will see “Switch to desktop version. Tap this and you will be sent to the desktop version. iPhone users will need to log in again. Android users will be sent directly to the desktop Member Home Page. There is no ability to switch back to the mobile version without logging in to the mobile version again.

Log in to www.mbsquoteline.com from your tablet. You will be directed to the mobile site. Log in to the mobile site. Tap Switch to Desktop Version. Log in to desktop version and use the remember me feature. Load the MBSQuoteline icon on your tablet. To load the icon, iPad users will be prompted to tap the Up Arrow Share button and the icon will appear. Android users will tap the menu button and then ‘add to home screen’. In both cases, you may need to identify the icon as MBSQuoteline.

Subscription Management FAQ’s

Bronze – Personalized weekly newsletter to market to clients, Realtors, and other referral sources

Silver – Bronze plan plus real-time MBS market updates and alerts via email and text

Gold – Silver plan plus access to our website (live prices, analysis, charting, events calendar, & much more) from all devices

Platinum – Gold plan plus forward months and live GNII prices (designed for secondary)

Contact us for pricing.

1-800-627-1077

We’re so confident that your MBSQuoteline subscription will help you make better lock/float decisions, make more money and become more of an expert in your clients’ eyes, that at any time within 30 days of joining, if you are not completely satisfied you can cancel your subscription and receive a full refund. No questions asked. We’ve taken all the risk out of subscribing to MBSQuoteline, so you can take advantage of all the rewards. See Terms and Conditions for more information.

FAQ’s: Markets

We also analyze every event in both the short term and the longer term that may impact MBS prices and address the degree of risk each poses. Our approach recognizes that the risk tolerance and time horizon of each person is different, so the only proper forecasting method would be to tailor every recommendation based on your unique preferences. Otherwise it would be similar to a financial advisor recommending the same investment portfolio for all of our members. We always provide the most up to date assessment of MBS market conditions and risks on the horizon, so that you can make the best decisions when you need to based on the amount of risk you are comfortable with.

By nature, markets react to the unknown. In most cases, we believe that an accurate assessment of the riskiness of the market, meaning how likely it is that there will be large price movements, is the proper criteria for making your decisions.

MBS prices by convention are quoted in thirty-seconds of a point. In our price presentation the first two numbers after the decimal point will always range from 00 to 31. A price of 100.040 means 100 and 4/32. Since 1/32 is equal to 0.03125, a simple rule to convert from fractions to decimals is to multiply the number of 32nds by 3. For example, 4/32 is about equal to 0.12 or 12 basis points. A conversion table dropdown box with the exact conversions is available on the homepage.

Our prices also display a third digit after the decimal point, which could be 0,1,2,3,+,5,6, or 7. These represent eighths of a 32nd, with the + replacing a 4. For example a third digit that’s a 7 means the price is some number of 32nds plus 7/8 of a 32nd, while a + means 4/8 or 1/2 of a 32nd. To sum up, a price of 100.173 means 100 and 17/32 and 3/8th of a 32nd. (In basis points this would be a price of 101.54297.) We round the third digit in all commentary.

Can I see prices in basis points rather than 32nds?

You can see prices in basis points under our Charting Tab. Both the Short-Term and Long-Term charts track prices in basis points. Mouse over any point on the price tracking line to see what the basis point price was at that time.

In addition, you have an option to receive our emailed market updates and alerts and our text messaged alerts with the MBS prices and price changes discussed in basis points. This option can be made through the My Profile section of the web site under the Edit Delivery Preferences tab, or you can call in your request to 800-627-1077 or email info@mbsquoteline.com.

Selecting this option will not change what you see on the MBSQuoteline website. The prices and price changes in the price tables on the website will continue to be shown in 32nds, as described above.

Every time a trade takes place in the market, the prices will update within seconds. The 9:45 est pricing level (a benchmark time around which most price sheets are issued) is displayed just above the prices table.

Selecting this option will not change what you see on the MBSQuoteline web sites. The prices and price changes on the web sites will continue to be shown in 32nds, as described above.

The daily pricing is typically released by investors around 9:45 AM est, and repricing will usually occur during business hours.

So suppose you have two loans, one at 6% and one at 5.25%, and you are watching the market to make an informed decision about when to lock them. The 6% loan would likely be placed in a 5.5% MBS coupon, while the 5.25% loan might be placed in a 5% MBS coupon. These coupons not only have different prices, but how much their price changes as the market moves can be different too. So we provide you all the coupon prices so you have the information you need for any loan you have.

Feature FAQ’s

We also analyze every event in both the short term and the longer term that may impact MBS prices and address the degree of risk each poses. Our approach recognizes that the risk tolerance and time horizon of each person is different, so the only proper forecasting method would be to tailor every recommendation based on your unique preferences. Otherwise it would be similar to a financial advisor recommending the same investment portfolio for all of our members. We always provide the most up to date assessment of MBS market conditions and risks on the horizon, so that you can make the best decisions when you need to based on the amount of risk you are comfortable with.

By nature, markets react to the unknown. In most cases, we believe that an accurate assessment of the riskiness of the market, meaning how likely it is that there will be large price movements, is the proper criteria for making your decisions.

Prices on the chart reflect the gains or losses since the prior day’s close. For example, a change of .02 means that MBS prices are 2/32 higher than yesterday’s closing level. Similarly, -.04 means 4/32 lower, and .00 indicates no change from the prior day’s closing level. Positive changes for the day are shown in black and negative changes for the day are shown in red.

You can choose to display the GNMA pricing chart on the homepage in place of the FNMA chart. You can easily switch back and forth between the two charts at any time with one button click.

Please note that the quoted pricing in all our updates is based on FNMA pricing.

Located below the pricing chart, there is a conversion table dropdown box which shows the conversion between 32nds and basis points.

Daily News & Analysis

Get right to the meat of the market by following top stories as they happen. With MBSQuoteline, you’re constantly connected to the news and events moving the MBS market, including expert analysis that digs even deeper into what’s happening. When you know what’s moving the market and why, your clients see you as the expert, and knowledge becomes more than power, it becomes profit.

Week in Review

With a quick, concise weekly recap, you know where you’ve been and where you’re going. Not only can you reflect on the news and numbers that shaped the market last week, you can give your clients something to think about. Use the MBSQuoteline Week In Review as an update for clients, or to keep in touch with realtors. It’s an impressive reminder of how diligently you’re tracking the market on their behalf. This great marketing tool — an MBSQuoteline exclusive — is e-mail and printer friendly. Just click on the link and send it on.

Month in Review

There’s nothing like a little historical perspective when it comes to the market. A comprehensive look at where last month went and where next month is going, puts yet another powerful tool in your hands. Why not share it with your clients and realtors? Interesting and informative, it’s another great marketing tool available exclusively to MBSQuoteline subscribers.

Trading volume sometimes has an impact on MBS markets. During periods of light trading volume, movements in MBS prices may be larger than average. With fewer active participants, prices might have to move by a greater amount to find someone willing to take the opposite side of a large trade

Usage FAQ’s

Log on to your LinkedIn page.

-Where it says “Share an update…” type a note/intro, for example “Mortgage news from MBSQuoteline this week…” then reiterate the newsletter title.

-Scroll to the bottom of your newsletter. Hold your mouse over URL link starting with “http://www/mbsnewsletter…, right click and select ” Copy Hyperlink.”

-Return to LinkedIn and after the note you typed, right-click your mouse and choose PASTE.

-Then click on SHARE!

——Facebook

Log in to your Facebook account.

-Where it says “Share an update…” type a note/intro, for example “Mortgage news from MBSQuoteline this week…” then reiterate the newsletter title.

-Scroll to the bottom of your newsletter. Hold your mouse over URL link starting with “http://www/mbsnewsletter…, right click and select ” Copy Hyperlink.”

-Return to Facebook and after the note you typed, right-click your mouse and choose PASTE.

Then click on POST!

—–Twitter

-Log on to your Twitter page.

-In the open box to Compose new Tweet, type a note/intro, for example “Mortgage news from MBSQuoteline this week…” then reiterate the newsletter title.

-Remember to keep it short due to the max character length in Twitter.

-Scroll to the bottom of your newsletter. Hold your mouse over URL link starting with “http://www/mbsnewsletter…, right click and select ” Copy Hyperlink.”

-Return to Twitter and after the note you typed, right-click your mouse and choose PASTE.

-Then click on TWEET!

In MS-Outlook, select your address book and click “New Items in the top left corner, then “More Items then ‘Contact Group.

Name the new group something that will help you to remember who is included in this group, such as ‘MBSQuoteline Friday Newsletter.

Add individuals by using “Add Members (brings up options; double click on each name to add) or by selecting “New E-Mail Contact to individually enter names and email addresses.

————–We suggest keeping the size of your distribution lists under 50 recipients so you are not detected as spam. If you have more than 50 you’ll need to create multiple distribution lists.

On Fridays, upon receipt of your Mortgage Time newsletter, select the Forward command. Delete the text “FW:” that precedes “MBSQuoteline Weekly Newsletter”. Delete the “To/From/Subject/Sent” information that appears directly above the newsletter.

Now enter a name of one of your Contact Groups, in the BCC field. *****Doing so insures the privacy of all recipients (each person’s name & email address will not be visible to all others receiving the newsletter).

We suggest that you enter your email address in the “To field so that you receive a copy and know that it was sent properly.

Hit “Send” .

All the latest versions of Internet Explorer (IE) use the Autocomplete feature to perform the Autofill function. But if you need to do so manually open IE then go

to -> Tools -> Internet Options -> Content Tab -> AutoComplete section

-> Settings -> Check All Boxes -> OK

The latest version of Firefox uniquely enables the Autofill feature automatically. Note that if you have never filled out a form before, you need to input all of your information the first time before Autofill will begin to work with Firefox.

If you use Google Chrome open the Google Chrome browser. Click on Menu button -> Settings -> Show advances settings…Under the Passwords and Forms, check Enable Autofill to fill out web forms in a single click -> Click Manage Autofill settings. Fill out all the settings you want saved and click OK then Done.

Safari users open the browser -> Menu -> Preferences -> Click or tap the AutoFill tab -> select the checkboxes next to the forms you would like Safari to fill in automatically.

For the mobile site, see FAQ for the “Keep Me Logged In” feature.

Company FAQ’s

To receive by-the-minute updates on mortgage-backed securities, try our platform free for 14 days. Stay connected with MBSQuoteline on social media by following us on Facebook, Twitter, and LinkedIn.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. To learn more about the MortgageTime™ newsletter, please contact MBSQuoteline at 800.627.1077 or info@mbsquoteline.com.